The bankruptcy of Bitcoin as a social project

The bankruptcy of Bitcoin as a social project

Bitcoin is inhumane, anti-social, has selfish qualities and as a social project is absolutely doomed to fail. A nice clickbait-like opening of course but follow me in my thinking and you will probably discover, like me, that there is truth to this statement. Bitcoin is preached by its proponents as if it were a religion. Hosanna stories abound, negative comments are responded to in the sense that you are too dumb to understand what it is about, and opponents are dismissed as if they were the personification of the old evil capitalist system. Let me make one thing clear before continuing with my story: I am not an opponent of Bitcoin, blockchain, cryptocurrencies and everything else, but I am not a taciturn follower either.

Author: YS Koen, Klaten, 23 March 2021

I have written about it before, but I will do it again for this article, since 1993 I have been directly employed in the financial sector most of the time. Initially as a research analyst for soft commodities and later as a financing specialist, of which since 2005 as an independent consultant. Hence my affinity with Blockchain, if with a background like me you do not know about the existence of Blockchain and the possibilities of it, then you have probably been lying under a rock somewhere.

Blockchain is not Bitcoin, Blockchain is more the infrastructure on which Bitcoin is built. Blockchain technology was first described in 1991 by Stuart Haber and W. Scott Stornetta, two researchers who wanted to implement a system that would not tamper with the timestamps of documents. But it was not until nearly two decades later, with the launch of Bitcoin in January 2009, that blockchain got its first application known to the wider public.

This is not about blockchain, although it is far from perfect, blockchain is something that we will not say goodbye to, the blockchain technology really has benefits for everyone in this society. This is also not about cryptocurrencies, or the usefulness of cryptocurrencies. In fact, this article is not about Bitcoin as a “product” either, because for me it is clear, Bitcoin is the future. Where my concerns lie is in the name, Bit-coin, money in the form of coins and the associated social project – means of payment.

Now half the Bitcoin community will fall over me that I dare to discuss this, but it is not a solid replacement for the current currencies as how it is suggested. The fact that it has a limited quantity makes it a disastrous project to introduce this as a general means of payment to the public. Because in this variant the project is finite and therefore doomed to fail. In the long term, the limitation has everything it takes to cause major unrest.

Studying Bitcoin as a resource

This is something that I have thought about for a long time as I am really studying the case of Bitcoin. I will not say that I was one of the first “believers”, but my interest was raised at a relatively early stage. That attention diminished when too many charlatans appeared on the scene. There was a time when every self-proclaimed trader and broker would tell the public how to invest for the sole purpose of filling their own pockets. There was no self-cleaning mechanism within the community to stop such practices. The public needed to be protected from themselves, but no one in the community who felt responsible for it. That was the time when I did not want anything to do with it. But then it took off again and I started looking at it again. This also has to do with the whole situation around our company in the time of a pandemic.

We are investigating how we can implement cryptocurrencies in business operations and benefit from this. Problems often arise when I ask others for advice on this topic, such attracts fortune-seekers with questionable reputation. So, I did do my own research and started an in-depth analytical study. I make grateful use of the models that I have collected over the years and my own view on an investment object. In doing so, I will not be guided by the upside of the investment target. Making a profit depends on a variety of factors and it is usually up to the investor to determine when certain actions should be taken to safeguard any profits. The investor has the option to exercise control when they want to take profits. But what does an investment object look like upside down?

The investigation started with Satoshi Nakamoto’s famous “white paper”, then I went through the email conversations and studied the source code. These were fascinating conversations between Satoshi Nakamoto and Hal Finney, James A. Donald, Ray Dillinger, Mike Hearn, Gavin Andresen, Adam Back and many others. Forum posts, external articles, books and much more. Do I know everything now? If only it were true, the discussion started in mid-2008 and we are now at the end of February 2021 and it is only now starting to really take off. I do not pretend to be an engineer; I do not pretend to be a software or programming engineer. I am a data analyst with a financial background. I draw certain conclusions from the data that I am analyzing and again examine that conclusion to determine whether I have not acted in a biased way. But above all, let me emphasize that every article, every opinion piece and even books and epistles must be seen through the eyes of the writer, it is not objectively.

For the convenience of this article, I point out 2 factions within the Bitcoin community, on the one hand we have technology/development and on the other the commercial faction. Of course, the whole matter is much more complex and there are many more facets to highlight the entire crypto/blockchain development. But that does not fit in one article, it takes several books and others are much better at writing that down. This article is only part of my overall study, but so fascinating that I am taking the time to present it in an article. This article is about the commercial/ user-side of Bitcoin.

Let me start by expressing a deep respect for everything and everyone involved in the development and creation of Bitcoin, especially since 2010, the world has been under the spell of this phenomenon. On the technical/development side of the project, phenomenal things are happening. Just try to comprehend the task they have taken on. If they succeed in their goal, the way we think about money will be put in a completely different perspective. With “we” I mean the whole world. I dare to say that on this side of the development there was no other motivation than to serve the public’s interest. No money-hungry types who wanted to rule as dictators. The creator of the whole, Satoshi Nakamoto, of course contributed to this. That this person has disappeared from the scene as he/she has come, suddenly he/she was there with an incredible plan and so suddenly he/she had disappeared again. Only to make himself/herself heard once more, when an innocent man was haunted by ghost stories because a journalist thought that person was Satoshi Nakamoto. That is the spirit that hangs over the whole project, nobody is more important than the goal that is being pursued. There are struggles within the technical group, but that is about the development and not the ego of a person or faction of the total group. I have nothing but good to say about this side of the project and I expect it to remain so in the long term.

How different this is within the commercial side of the project. Of course, this was to be expected that this story would attract fortune seekers. Again, and again I am negative surprised that the commercial side cannot muster the decency to develop a self-cleaning mechanism that will stop absolute evil spirits. We need the people for this project to succeed, but no one in the community will protect the public when absolute criminal activity is taking place. The Bitcoin project and other cryptocurrencies are plagued by criminal activity. This has regularly been translated into Bitcoin’s price development and so you would expect the community to act, but unfortunately, they remain quiet, and they count on it that various government services will act.

This is contrary to what they are trying to fight for. The crypto community is fueled by libertarian thinking, but on the other hand, they cannot afford to set up a self-cleaning mechanism and look sheepish until government agencies act. On several fronts, the crypto community on the commercial side adopts an almost animalistic philosophy: “Part of a herd in which the weak are pushed out and become victims of hunting wildebeests that can easily consume the sick and weak for lunch.” You do not see this behavior on the technical side of the Bitcoin story. If there are differences of opinion, it is precisely about how to increase the reliability of the entire system.

The entire Bitcoin project was conceived from a libertarian mindset to bring control of “your own money” to the masses, instead of following the guidelines of the current financial “system” in place and voluntarily leading us to the slaughterhouse. This is 100% the fault of “the system”, because where was the self-cleaning capacity of “the system” after, for example, the crisis of 2007-2008? There is absolutely no legal excuse that could justify all those bailouts. But it was forced on to the public and the public had to accept this and pay the bill. Anyone who sees even one bailout as a good thing has a self-interest in that. Legislation in this has also failed the public.

I have been warning about the dangers of a cashless society for over 20 years. Only a few want to listen to this, but the dangers of these are becoming more and more visible. Then again, I say that the real dangers have only just surfaced. They just do not want to think about it, but total control on spendings is what the public will receive if we do not give the Bitcoin / crypto project the space to develop further. Although it cannot be ruled out that the same dangers could creep into this project, in fact, the door is wide open for it. This has everything to do with the fact that any entity can have transactions executed, even if that entity is anonymous. The system is transparent, but the participant can remain anonymous. So also, bots with bad intentions, or worse, bots with influences from government agencies that want to put pressure on the system. Just read, with a creative mind, the prelude to Life 3.0, the book by Max Tegmark. Such a thing cannot be ruled out and for that reason alone I take it into account.

For the individual, the current financial system and a cashless community is a threat to financial independence. Example: you are 50 years old, you have no mortgage, no loan, no debts, a minimum monthly salary because you supplement the rest with profit distribution from your company, your company is financially healthy. In that situation, try getting a loan from a financial institution. The chance of success is 0%. In the above scenario, you are unknown, anonymous to the system, so you can pose a danger to the system. Even if you have more assets than the amount you want to borrow, they still will not provide a loan, or you will have to provide a multitude of assets as collateral. Why would you take out a loan under such conditions? You are almost forced to be in debt, then you are loved by the system, because then they can check whether you are paying on time. But if you then state that you have built those assets by working hard, even if you show your annual tax remittances, still it is not enough to be loved within the system.

This is rather a positive example, because the person in the example does not have an acute need for that loan and will be able to resolve their credit demand on their own. But what about people who are in a much worse situation and are out of the banking system for whatever reason, whether they will do anything to pay off that loan on time or even speed up the process, it does not matter at all. If those people have an acute financing need, they are depending on loan-sharks who lend money at absurdly high interest rates. It is all about control of the individual, if you do not wish to follow their guidelines you will be characterized as unreliable in advance. For that reason alone, the public should embrace cryptocurrencies because self-determination over your own financial situation is feasible and you no longer need to be a pawn of the current financial system of government-central bank-commercial bank.

The shortcomings of commercial parties within Bitcoin

Bitcoin nowadays is promoted as the eighth wonder of the world, or the new wonder of the world of our time. More than wanting to know if it is a wonder of the world, I wonder what the importance of those promoters is in blowing this high off the tower? Maybe I screwed up the algorithm of Google and YouTube myself while researching cryptocurrencies, but I have recently been inundated with information about Bitcoin and other cryptocurrencies. The aggressive price increase will also have to do with that, but you can no longer ignore the fact that it is something that we must consider that it is here to stay. Just as I have often delved into the technical matter of blockchain and cryptocurrencies, I also have an attentive ear for what the commercial side of the story has to say.

To be honest, the noises I have been hearing lately do not exactly make me happy. There are a lot of self-proclaimed prophets and as soon you are critical of the story they are preaching, you will be declared an opponent, or wrong. It will be in favor of the whole Bitcoin community when as many people as possible embracing Bitcoin. Because many within the Bitcoin community have looked with some jealousy at what was going on around GameStop. The public took matters into their own hands to wage war against “the system” and in one area the crowd has won a clear victory. It has been a long time since both the left and right sides of politics agreed that something should be done about the dominance of the few and thus seem to gain an unfair advantage that adversely affects the many. In no other sector of the economy would such a thing be accepted, because then we are soon talking about cartel formation. But a handful of industry players in the financial sector have ruled the business for many years and if they get it wrong, they will be bailed out by politics. With the excuse that they are too important for the economy. It is time that things will change, and the decentralization of personal finance will certainly help with that, especially if the public is to keep putting pressure on the financial industry.

If you and I were to carry out such practices, we would be punished and imprisoned for a long time, but for the sake of a strong economy, these financial parties will not be hindered. However, the common man in the street has not noticed a good economy for many years, they seem more likely to be victims within this system. Including absolute control over spending by a cashless society. A new initiative like Bitcoin could put an end to that. But what happens, the people are called up when they are needed, only the people will not be protected when they need it. Because then it is everyone for himself and God for all. Let me make one thing clear, God has a deaf ear to your and my financial concerns.

Lately, parties with considerable financial leeway have come on board with Bitcoin. Immediately you see that there is a movement to take advantage of this, people want to do everything they can to skyrocket the price of Bitcoin. But this with an unbelievable haste, this immediately raises the question in my mind: why is there such a hurry, what importance do people have in this? Bitcoin is not mature enough to hold that higher price for long, the fluctuations will be enormous. Then you have parties preaching that speculators are to blame for selling. But point me to a market that is not prone to profit taking or investor’s impatience? Where you ask the public to participate in a bull market, you should consider the increased levels of emotion towards the prize. Who determines when enough is enough?

It will take time for Bitcoin and other cryptocurrencies to mature. It is still a time of uncertainty, although that uncertainty in Bitcoin is getting smaller by the day. But then the Bitcoin community will have to present itself better. There may still be a turning point where governments can make decisions that are detrimental to the survival of Bitcoin and its cohort. To be fair, there are regular voices that do not make me happy and that are absolutely against the interests of governments. One of those things is the rampant rumble about tax avoidance. This will not promote a positive assessment by those governments. Tax evasion coupled with increased anonymity does not help make cryptocurrencies acceptable to governments and central banks. It gives the commercial banks tools in hand when it comes to defending their “monopoly” position in banking. You may want to fight for decentralization, but that does not mean that you are no longer part of a society.

I am not going to say here that we should pay unlimited amounts in taxes and that governments should not be held accountable for how those taxes are spent. But crowing like a rooster that it is the perfect way to avoid taxes will backfire. A government will never tolerate large-scale withholding of tax revenues because the right to collect taxes is what keeps the current monetary system afloat. Outside of the interest of the government when it comes to collecting taxes, how do you intend to explain to others in your community that you will do everything you can to evade taxes and thus lay the bill on them? Standing up for self-interest should not be confused with selfishness. We all will have to contribute to a better society and, unfortunately, that includes paying taxes.

The biggest threat to Bitcoin as a social project

Having said that, we have now finally arrived at what I consider to be the greatest threat to Bitcoin in a social context. Let me emphasize again that I am an absolute supporter of Bitcoin and that I will do everything what is in my power to make Bitcoin a success. Because it is the first major project that people have in their hands to be able to exercise absolute control over its own financial affairs. Because of my work experience, I know the traditional banking world through and through and that does not make me particularly happy. We hope that with the introduction of bitcoin people will get a level playing field. But the same people will need to better understand what it all means to switch to cryptocurrencies. Unfortunately, it takes years for people to get a grip on it. It is a very complex matter; I do not pretend to understand everything in detail. We must educate ourselves in the workings of Bitcoin and Blockchain. We will have to be patient for what the possibilities are within the systems. We are only now going to see what the systems are capable of. Every time there comes more usability, but it is only just beginning. That is precisely why we will have to form a close community and we need everyone. But that also means that we must keep learning. Because the “old” financial system, with the help of governments, will do everything to dismiss all new developments as wrong and undesirable.

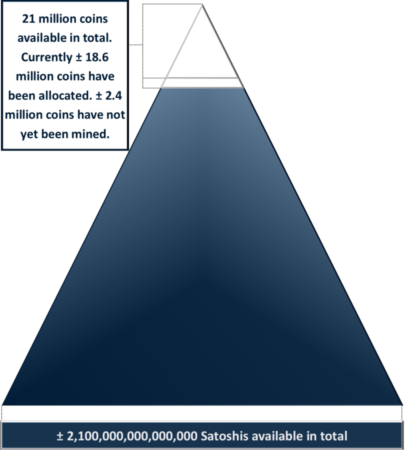

Where my reluctance comes from has to do with the limited quantity of Bitcoin, 21 million pieces. For that reason, it will never become the social project as it is now being preached. I have tried to follow several conversations on this topic, but it seems that it is illegal to talk about it. Because the limitation on the quantity will limit the intended growth. This is not a stumbling block for now, but there will come a time when it acts like a boomerang to halt further growth. What is my position focused on? The more people participate in the Bitcoin project, or buy Bitcoins, the faster that pressure will come on the system. Now, more than 88% of all coins have been mined. Only slightly more than 11% is therefore freely available. However, are they freely available? The answer is a clear NO. If you do not have a mining operation, you will never have access to Bitcoins other than buying them from someone else. As currently calculated, it will take approximately until 2050 for all other coins/tokens to be mined. But that does not mean that miners are no longer needed, in fact, the entire system runs on it. Because without mining, no transaction can be processed. Verification and administration are what this is all about, and that as quick as possible.

Where miners previously earned their income from mining Bitcoin, they now mainly derive the income from processing transactions in Bitcoin’s blockchain infrastructure. Where previously this service was mainly funded with allocation of Bitcoins, now more and more a direct fee will have to be paid by the person offering a transaction. Because the protocol becomes more and more complicated and the costs therefore increase, the transaction costs for the user will also continue to rise. Especially because a trend has already been set in motion where the user of Bitcoin will have to pay a higher amount if they want to have their transaction executed with a head start. We have all heard that Bitcoin mining operation requires more and more power, so all things considered, you will have to pay a lot if you want to have a transaction executed. In addition, the matter of establishing a transaction is not easy, you are not going to do this if you are standing in line at a cash register somewhere and want to pay for your groceries.

So other parties will be needed who offer an app or something similar that simplifies the procedure for the user. Is this free of charge? I do not think so, because what is one of the lessons that we have now learned from working online. If you use a platform for free, then it is most likely that you are the product. Is that something you want for your financial affairs? It may be only fractions that you pay on the amount involved in the transaction, but a lot of small amounts together become an expensive pile. The question comes to mind, is Bitcoin the payment method of the future? Because when Bitcoin is the new digital money, let us define once more what money is:

- Unit of Account – A product and service have a certain value, but how is that value calculated? Money can reflect that particular value.

- Medium of exchange – For this we need a medium where both parties agree on what that value means. Because it is possible to exchange goods with each other, only that is less easy to transport. Money is then a perfect medium of exchange.

- Store of Value – Assets can be stored in, for example, a house, financial instruments such as stocks and bonds, goods such as gold and silver, but can also be kept in cash for which money is the best means.

It is precisely because of the limited quantity of Bitcoin that it will be limited in its possibilities. But the Bitcoin community does not want to touch that subject just yet. The community still declares Bitcoin to be the great all-rounder. Credit where credit is due, without Bitcoin I would never have written this article, so we should all be more than grateful to Bitcoin and the development community for what there is. However, before we start bringing everyone in by the masses as believers, we need to make sure they get to the right place. Those who have now built a great position are fine there, but that should never be a reason to continue to advocate for mass adoption of Bitcoin as the money of the future. Because then the whole project is in danger. The first to accept Bitcoin as the Store of Value of the future will become the world’s new wealthy when bitcoin becomes the money for general use. There is nothing wrong with that, because they have also been the ones who have given the breeding ground to Bitcoin to grow, from which all humanity can benefit. But those first participants also have a fiduciary duty, everyone is responsible for the success of the project. Because Bitcoin was the first, all eyes will be focused on whether the entire cryptocurrencies community will succeed. Bitcoin is not, and never can be, a general-purpose currency.

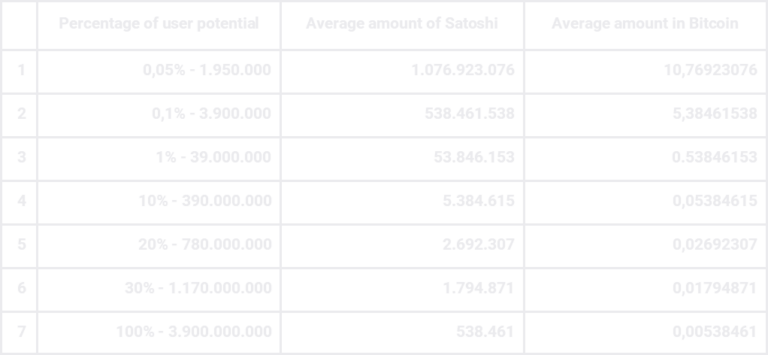

You have absolute believers who canonize the limited quantity of Bitcoin, because that is how they argue, the price can only go up. Then you have the other side that will say that the limited quantity it is not so bad after all, because every Bitcoin has eight decimal places. Or, where most traditional currencies have 2 decimal places, or up to 100 cents, every Bitcoin has 100,000,000 Satoshis. So, when everything is in circulation there are a total of +/- 2,100,000,000,000,000 Satoshis in circulation. It is almost not possible to pronounce that number. But let us get this back to understandable numbers. Current world population is +/- 7.8 billion people, of which 26% are non-adults, younger than 16 years old. Remains a target group of +/- 5.8 billion people of those numbers 31% currently have no access to bank facilities, so the current user potential is 3.9 billion people.

But wasn’t one of the thoughts behind the development of Bitcoin that we should include those who do not have access to banking facilities? An even greater user potential.

Numbers with many decimals do not mean anything to you, let us put it in dollars. We use the first table data as a guideline.

If this does not mean anything to you either, then maybe I have a different frame of reference, the US dollar: can Bitcoin be compared to the dollar? We can debate that for a long time because Bitcoin was nevertheless introduced as a digital currency for general use, where geographic boundaries no longer count. Then I say that the dollar is the closest, the dollar stands next to the currency of the United States, also known as the main reserve currency for the rest of the world. It crosses geographic boundaries, the same how Bitcoin was also introduced to us.

Here we try to compare the prevalence of the dollar with Bitcoin in the future, since in Bitcoin we still have far from the number of users that the dollar facilitates daily. But let us look at the dollar’s money supply. Which components are important to determine the money supply in a currency? Since we are using the dollar as a comparison here, we will use the American standard. Then we are talking about MO to M3 money aggregates. What is the definition of this M0-M3 and what is important in this?

If we want to use the dollar as a comparison material for Bitcoin, 2 parameters in this are important M0 and M2, as of March 2021 the US had a monetary base of almost $ 5.25 trillion. M1 was at $ 6.75 trillion and M2 at $ 19.4 trillion. Today the value of Bitcoin is +/- US $ 58,000.00 a market cap of US $ 1.09 trillion, well over 20% of M0. Bitcoin as a concept has the potential to become much bigger than the dollar, this could become the digital currency of every citizen on this planet. But is there enough out there to satisfy everyone? That is something I very much doubt. Because if Bitcoin becomes the great all-rounder that people predict, then we would have to compare this against M2 and then the shortcoming will come into the picture. About 18.65 million Bitcoins are currently in circulation. As described above, M2 stands at $ 19.4 trillion, which includes the decimals of 1.94 quadrillion units (including $ cents), while Bitcoin has currently no more than 1,865 quadrillion units (including Satoshis) in circulation.

The number of Bitcoins is fixed like no other currency in history. So other factors are going to play a more important role. Including the velocity of money, how quickly money changes from hand to hand. Time does not play an important role in this, but the number of transactions over a certain amount of money. This is where the limited number of Bitcoins comes into play as a topic when we talk about the threat of Bitcoin as a social project in this article. We will have to look at money differently than we have had to do so far. Especially since the 1970s, central banks have hypnotized us. Because as soon as the liquidity of traditional currencies was threatened, the money press was turned on again. Every now and then we panic when a bank run threatens to occur. Just look at the 2007-08 crisis, it was the politicians at the forefront who wanted to do everything they could to prevent that panic outbreak from happening. So, there was a hype in bailouts, aided by the money press of central banks. That possibility does not exist within Bitcoin. When all Bitcoins have been mined around 2050, nothing more will be added. That is, we all must do it with, 21 million Bitcoins, with 100 million Satoshis for every Bitcoin. We should have to think carefully about how we deal with that.

Halfway through the writing of this article I got stuck in my own thinking pattern, I was threatening to oversee something. Because what I had been working towards all along in my thought process was too easily confirmed when I started working out things on paper for this article. So, I needed help from others. But trying to align them with my thinking patterns was easier said than done. To get the result I was looking for I had to pour it into another barrel and see if they came to the same conclusions. When it comes to money, people often get stuck in the pattern of 2 decimal places. However, Bitcoin works slightly differently. So, to avoid confusion, I did not start talking about money, but about buckets of rice. Then I started to build the equation of 21 million buckets of rice and each bucket has a capacity of 100,000,000 grains of rice. What happens if you take buckets away, now you think for what, because there are 21 million buckets and that is certain? Yes, but there are so-called whales that hold large batches as the purpose of a store of value. At least 15% is owned by these large parties, 3.15 million buckets less. If we add to this that at least the same amount is designated for other purposes, now we are already talking about 6.3 million less available. That means, only 13 million buckets are free floating. This will only decrease in the future, so do not be surprised if less than half of the available Bitcoins and Satoshis are actually available for circulation. Compare that against M0 money and we are getting close. With the understanding that more than 80% of M0 money goes through American hands, that is only +/-230 million active participants.

Thinking that limiting quantity will have little to no effect on bitcoin’s stability is like running away from the facts. Just ask an economist what changes in the velocity of money means for prices of products and services? Then it is very nice to say that Bitcoin is not sensitive to inflation and deflation, but that is of course not the case. Because compared to what is there no question of inflation or deflation? Bitcoin should not have to venture into this area at all. I do understand that it was Satoshi Nakamoto’s ideal to make Bitcoin the currency of the people. But users have decided otherwise. This started when a price was put on Bitcoin, because from that moment on Bitcoin represented a tangible value. It is not for nothing that the first 2 years of Bitcoin had no price. To put it even more bluntly, I do not rule out the possibility that “Satoshi Nakamoto” has left the project for that reason.

From the moment that Bitcoin started to represent tangible value, other forces have come into play. It became tangible to the people. People need to have something tangible to understand it. Just look at most religions, beautiful conceptual thinking, but it is anchored by the people to symbols and tangibles. It gives people a grip on what they want to believe. For the same reason, the film industry has also become so big, capturing dreams and fantasies, making them tangible, because then we can believe in them. But that has become the death knell of Bitcoin as a social project, especially in the beginning. Other parties within Bitcoin have started to exploit this tangible value, while the project needed space to mature. That space is not given, people are impatient, we want to move forward. After all, Bitcoin was the means in the hands of the people to hack the established parties of the financial system. After 2008 there was really a good reason for this.

There is a certain group within the Bitcoin community who are using this valuation of Bitcoin to amass unprecedented wealth. Before, they always had the feeling that they had missed the boat somewhere. Now that Bitcoin is here, it seems to them that heaven on Earth has emerged. They see in Bitcoin the opportunity to amass so much wealth that it can become dangerous. They have always been diligently looking for a way to hack the system so that they can also have some of the cake for personal wealth. But who will suffer the consequences of such an act of greed? It must not get to the point where, for the greed of a small group, the larger group is in danger of becoming a victim. I strongly believe that the processes initiated from the moment of Bitcoin valuation cannot be reversed. That does not have to be a bad thing, Bitcoin can continue to play a very important role. But we all need a level playing field if we are to give cryptocurrencies and blockchain the real opportunity it deserves. Because again, a high price is no guarantee at all that Bitcoin will survive. In fact, exploding prices are a reason to look at it with suspicion.

Is it all lost, or what can we do that cryptocurrency concepts become the social project for everyone?

The question is whether everything is already lost, far from it, we are only at the beginning of something beautiful. It is now up to people to make optimal use of the possibilities. So, what needs to be done so that cryptocurrencies can live up to expectations and everyone can enjoy their full potential? Much remains to be done. First, we must avoid the technical/development side of the entire cryptocurrencies playing field. Let them do what they do best and let us not get in their way. Then what should be done on the commercial side? Much more, for example: do not mobilize the masses to acquire personal wealth. Recognize that Bitcoin is not the all-rounder now presented to the public. Give other initiatives room for further development. We do not need an idolization of 1 type of cryptocurrency.

With Bitcoin, it is what it is and no one is going to change that now. The Bitcoin community will have to ask what they actually want for themselves? Give space to allow Bitcoin to develop further as a “digital gold” currency, because I give it to everyone, if they do not and want to insist on being the great all-rounder and preferably the only one in this playing field, then I predict the absolute demise of Bitcoin. Bitcoin has shortcomings and these cannot be eliminated within the existing infrastructure. The same goes for Ethereum, a wonderful initiative, but do not stop there, make sure Ethereum stays and really adds something. Where Bitcoin can be the benchmark for price valuation for cryptocurrencies and thus also become a perfect store of value product. There, Ethereum can become the benchmark for proof of work protocols. But both sides will have to recognize that they are not perfect.

This entire process of Bitcoin and Blockchain is full of innovations. So many possibilities and all in the hands of the users. There is more than enough space for tokens and altcoins. So, let’s give them the space they deserve. Once again, the market is more than big enough. When this whole platform matures, there will be a market potential of 5.4 billion and more users. Why should you compete with others? The community sometimes shows the weird sides of hooliganism. Cryptocurrencies are not a sports association where competition and its supporters must be crushed. No one is better than the other, every cryptocurrency and blockchain process can have its own users. Utility Tokens, Community Tokens, Service Tokens, a custom token can be designed for any purpose.

Decentralized Financing (DeFi), Non-Fungible Tokens (NFTs), Commodity Tokens, Supply Chain Tokens, Crop Tokens, there is a world of possibilities open to use. Everything within reach of the users. Forget the system of fiat money where one was at the mercy of politics and central and commercial banks. The money as we know it now will be extended to what you and I need. There is still a long way to go but stay optimistic. Take the crop tokens for example, we all know that our vegetables are sold expensive, but the farmer who does his best to bring fresh vegetables to our plates is not getting his fair share of the proceeds. With a crop token, a network can be set up that is transparent and therefore much fairer. Or my ideal, the commodity token, commodity trading has been totally ruined by speculators and rotten traders. You doubt that explain to me why there is a market mechanism like OPEC? It is cartel formation of the highest degree, then you and I will have to see if we as end users get what we are entitled to. Or worse, whether the people involved in the extraction of the raw materials get a fair share. Is anything really done about the environment after it has been exploited? This can all be made transparent with a commodity token.

I want to leave it here for a moment. I hope you have been able to follow my concerns. Think carefully, do your own research, study the operation and possibilities of all products. Do not get talked into something to please others. But also try to look with a creative mind at the unprecedented possibilities that are ready for you and me. I am very positive about the unprecedented possibilities of cryptocurrencies, tokens and blockchain procedures. This is definitely the future; this is not going to disappear. But we will have to remain vigilant for players with evil characters.

Thank you for your attention. If you have any questions or comments regarding this article, you can reach me at the contact details below.

A publication of:

P.T. Emas Cemerlang Bersama

Axa Tower Lt.45, Jalan Prof. Dr. Satrio 18,

Karet Kuningan, Setiabudi, 12940, Jakarta Selatan, DKI Jakarta, INDONESIA

Tel: +62-821-1377-8883