COMMUNITY WELFARE PROGRAM, Revision of the Original Plan

If you would like to receive this document in PDF format, contact us:

Table of Contents

Part 1 Community Welfare Program

Project development is a process that requires time, patience, perseverance, and belief in one’s abilities. Anyone who has ever presented a project to the public knows it is complicated. The final model of the project will show significant differences from the model that was first shown to the public. That is no different with us. In the development phase, you have to go through a test process, in our case, by introducing the project to others. At first, as a hypothesis, which again complicates it because people consider it a dream, and dreams rarely become a reality. But by sharing the project with others, we get a better idea of what is feasible or bottlenecks that need to be changed. These changes and improvements are discussed in this blog.

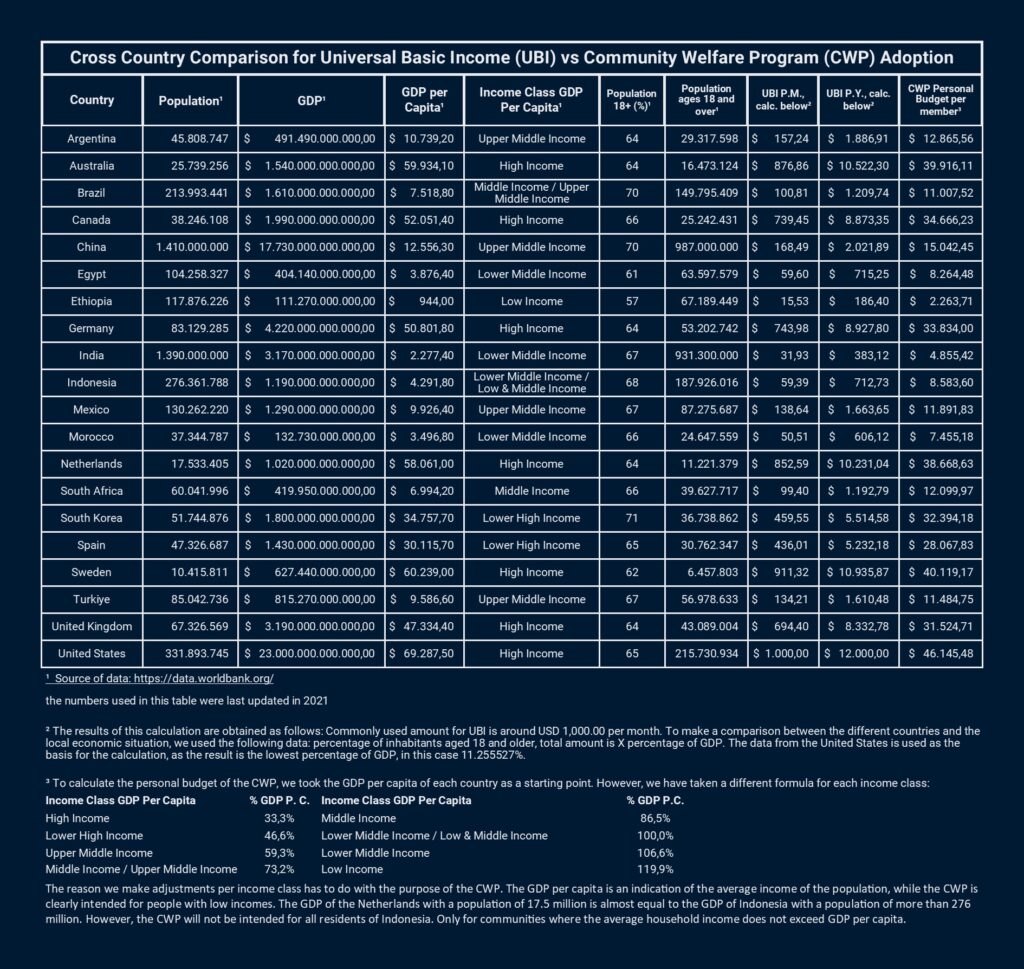

The project plans were previously described in a project paper and presented to the public. [1] We recommend reading this document first if you still need to become familiar with the content. Below is a brief description of the plans: The Community Welfare Program (CWP) is a social welfare program for all individual members within a particular community. The composition of a group of participants may differ as long as the objectives of the CWP are maintained. We choose to have all families within a neighborhood community participate in the CWP. A neighborhood community is deemed eligible to participate in the CWP based on an average annual income per family below the GDP per capita for the year in question, which is set at USD 4,291.80 for 2021.

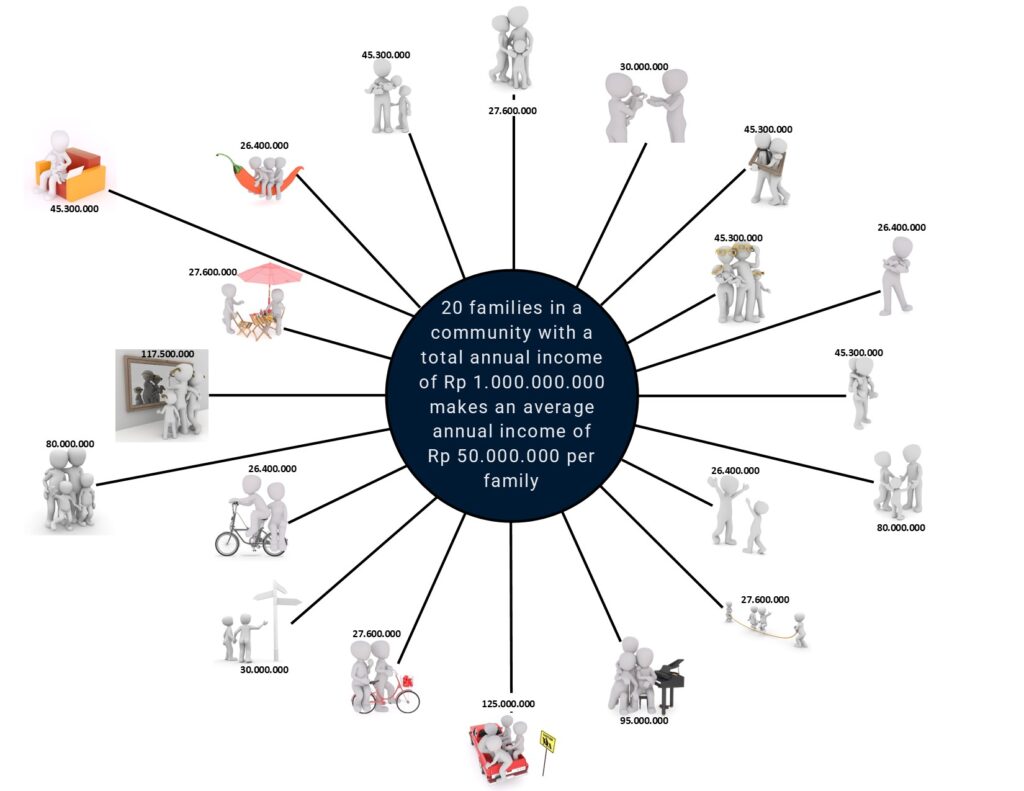

The objectives of the CWP are to reduce the wealth gap for the concerned members and to achieve a better financial future for the members by enabling financial planning. In addition, we strengthen the community’s economic situation to withstand economically uncertain times better. Each participant is allocated a budget of at least two average annual incomes of a member of the broader community. For the model we use, the personal budget is based on the average yearly household income of the wider community members. So if the average family income of the members within the community is set at, for example, IDR 50,000,000, then the members have a budget of IDR 100,000,000. (Again, in the model we’re using, the members are all households within a particular community, so an individual member is an entire family, not an individual, so the budget is for the whole family, not for each person of the family.)

To do full justice to all the objectives of the CWP, we use three themes within the program: Individual, Communal, and Future; these are the three pillars of the CWP:

- Individual: Direct benefit to members is necessary for the adoption of the CWP to continue, and one will wonder why they need the CWP. The program starts with an individual theme, in which the participant receives a personal budget. This is not intended to supplement the family income but as a financial reserve in case of emergency. It is a credit reserve that they can freely dispose of, but a withdrawal from the personal credit reserve comes with a repayment plan. It is up to the participant whether he keeps to the agreement. However, if the participant doesn’t comply with the arrangements made several times, this can ultimately lead to exclusion from the program.

We choose this solution because everything stands or falls within fulfilling agreements. If no conditions are attached to the use of the money, then people will consume it without benefiting in the long run. People often live paycheck to paycheck; at the end of the month, there is probably nothing left to set aside for emergencies or extraordinary expenses. We want to inform participants of the benefits of money management and that they can independently have a financial safety net through manageable costs.

Of the total budget, one-third of the funds will be made available for this pillar of the CWP. This is an interest-free personal credit reserve. Once the participants are allocated the amount, it is theirs and will not be taken away; it is up to the individual members how they ultimately deal with the expenses and repayments.

- Communal: Within this pillar, the participant receives a budget to invest with the other community members in financing (local) business activities. When a community member submits a funding application, it gets priority in the underwriting process. We recommend that the members only provide financing within this pillar for short to medium term (1 to a maximum of 24 months).

The members are jointly allowed to vote on a financing application and the amount each participant will add to the total investment. The member concerned will be allowed to share the investment proceeds proportionate to the respective participation amount. By participating in this pillar, members are enabled to increase the principal amount of the personal credit reserve or, in this way, contribute to the repayment of outstanding amounts under Pillar 1 of the CWP.

The reason we want to carry out this process together has to do with solidarity. We are building a stronger community together and reaping the benefits together. In addition, it must be possible to finance multiple projects to achieve a positive result and drastically reduce the chance of failure. If the members have to do this independently, they can make little or no diversified investments. Then there is the risk of a disastrous outcome with all the associated financial and social consequences.

- Future: Within this pillar, members receive the offer to save and invest with a longer time horizon. The proceeds from these investments can be used for major later-term expenses, such as retirement, a college scholarship for a relative, or a down payment on a house or whatever. Ultimately, it is up to the members concerned where they want to spend the proceeds of the investments. However, when a member withdraws an amount and reduces the total amount within this pillar to less than the initial amount, participation in the CWP will be terminated.

With the help of an investment coach, participants can have a risk profile drawn up and decide which investment products they want to invest in. Initially, there will be a modest number of products, but we expect to be able to offer a wide variety of investment products within a few years. Members decide for themselves which products they choose.

Above, the reader has just been able to read a short description of the Community Welfare Program and the three different pillars within the program. For a more substantive description of the project, we refer to the full content of this blog and previously published documentation about the CWP.

Initiator’s Note: This program was not designed to make anyone rich. What is wealth, and why should we pursue it? This is not about amassing wealth at all. This program is designed to provide members with structural financial change. We are talking about a drastic change for an entire family from just USD 6,700.00 to USD 10,000.00 in a way that will leave no one feeling shortchanged, not even the investor who gets more than enough value for money. That is the difference we can make, not for 1 or 100 but soon for a million or more families anywhere in the world. And that’s just a start. This program will not drastically change world poverty, at least not by us alone. This program shows we can act together and make a difference in our community. A community does not have to be defined by physical boundaries; a society can arise because we want to pursue a goal together. This can be achieved, and at the same time, everyone can benefit from it. By realizing this, we can set an example that others can pick up and repeat; then, we can make a difference together.

[1] https://www.emcebe.com/project-2-community-welfare-program/

Why a Community Welfare Program?

In particular, the “Great Recession” [2] of 2007-08 has revived the discussion about a Universal Basic Income (UBI). [3] But more than a discussion, what has been achieved so far? This question will remain largely unanswered because, aside from some well-intentioned initiatives, few have made a difference and never progressed beyond the initiative phase. Indeed no initiatives have been tested over several years or introduced as standard. Meanwhile, the wealth gap is widening. In general, a UBI has two weaknesses in the commonly used format:

- How should a program like UBI be financed long-term? No more thought has been given to this other than shifting existing budgets or through an increase in taxes for the wealthy and companies.

- Putting the ball in the government’s hands to run a UBI program can jeopardize its long-term survival. The UBI will always be the plaything of politics during elections; there will always be a threat of a changing political landscape or economic situation that could stop such projects. We find this unacceptable for the beneficiaries of such initiatives.

Should we do nothing at all? No, doing nothing is ignoring the problem. The situation we are in because of the pandemic has again made it clear that something must be done. A vast majority of the world’s population has suffered very negative economic consequences from this pandemic. While some governments provide financial support to their citizens during a pandemic, others cannot offer any assistance. Globally hardest hit are people in the lowest income bracket.

All this does not alter the fact that our objections to a program such as the UBI remain. Again, these objections are not there because of the objectives pursued by such programs. The complaints mainly lie in the financial underpinning of such initiatives. Added to this is the potential threat that there may come a time when such projects cease to exist because they are no longer on a new government’s political or economic agenda. Introducing a program such as UBI, letting participants anticipate it, and terminating it for whatever reason after a while, what is that for a solution? Because who is going to solve the problems that arise from this? For a UBI to succeed, it is vital to spend the money provided rather than saving it for later. Getting used to extra financial resources is faster than anyone would think. One more thing: “Don’t start a popularity contest on the backs of others.”

Initiator’s Note: Take a country like the Netherlands, with more than 13.5 million inhabitants over 20, with a monthly contribution from the UBI of 500 euros; the annual government obligation is 81 billion euros. In the case of the Netherlands, this would therefore be more than 24% of government revenue. [4]

This is such an expense that it will be a point of discussion every year when the national budget should be compiled. Governments will only be willing to commit to such a program briefly. Besides the above, if you get a government to implement UBI as a policy, you have created the ultimate form of “Shush” money. “Shush” money is a form of payment where the payer tells the recipient to be quiet.

“Never bite the hand that feeds you.” This can lead to an imbalance for the recipients, those who do not need it have a dominant position over those who urgently need such a financial contribution. This drastically undermines the objective of reducing the wealth gap.

An example is the incentive checks issued to the public during the pandemic outbreak, and what did they do with it? Stock markets skyrocketed, and governments continued to sell nonsense that the economy was robust enough to withstand the pandemic. The public was lulled to sleep with what they believed to be quick-earned riches. Few dared to openly criticize the government’s actions because you were soon dismissed as a conspiracy theorist; you disrupted the party of many around you.

What eventually remains of all those quickly amassed riches? Nothing. Billions have since evaporated, and all we’re doing is yelling at the government to come up with something better soon. The ever-increasing inflation is now hitting the public, and we have yet to be armed against such a calamity. We don’t need a government that gives money away as a gift but quietly manipulates how we spend it. We, as a community, know better; we can help our neighbors do better. Together we can make a difference.

Then there are several things where our initiative deviates from the model the UBI has chosen. Regulation and commitment are essential within our model. Members are free to spend the budget within Pillar 1 as they see fit. We expect members to adhere to the agreements made in the repayment schedule. The schedule is an agreement each member makes for themselves, but we closely monitor adherence to it. The repayment schedule mainly contains agreements about the frequency and amount of the repayment. If a member concerned does not have sufficient financial resources and cannot fulfill the arrangements, the member is offered the opportunity to perform “paid” activities. If the member concerned does not want to use the options offered and does not want to comply with the agreements, sanctions will follow, leading to complete exclusion from the program.

The CWP has not been developed to supplement existing income but is intended as a financial safety net for “emergencies” when expenditure must be incurred without the financial resources being readily available. However, it is ultimately up to the members to determine what the credit reserve is used for, as long as agreements on repayment and frequency are respected. We only give advice but do not restrict the available resources; everyone should be free to decide what is important to them. We emphasize fulfilling existing obligations because it entails a certain degree of (financial) discipline. This program is meant for the long term, not just for a short-term feeling of happiness.

[2] https://en.wikipedia.org/wiki/Great_Recession

[3] https://en.wikipedia.org/wiki/Universal_basic_income

[4] https://www.rijksoverheid.nl/onderwerpen/prinsjesdag/inkomsten-en-uitgaven-van-het-rijk-2022

Key Features of the Community Welfare Program:

- A member receives a financial reserve equal to twice the average annual income of the group members. If the members have an average yearly income of USD 5,000.00, then the financial credit reserve for each member is USD 10,000.00.

- This financial reserve can be used for three purposes:

- Pillar 1 – Individual; One-third of the amount in the financial reserve can be used individually by a member to increase spending temporarily. The funds are made available through a revolving loan agreement with the members. To access the funds, a member must meet the loan agreement terms. A member submits an application stating the loan amount, including the number of repayment installments and the repayment amount per installment. As long as the member concerned adheres to the agreements made, the total amount under this pillar remains at the member’s disposal.

- Pillar 2 – Communal; A second part of the reserve, again a third of the available amount, can be used to finance commercial projects within the own community. This is done together with the other members of the community. By doing this jointly, the members have more financial capacity to spread investments and thus reduce risks. Preference is given to short-term investments, max six months, to the medium term, max eighteen months. This is ideal for micro and small businesses with little or no access to the traditional banking system and often rely on loan sharks who charge sky-high interest rates. The organization assesses each investment request for reliability and feasibility and then submits it to the members for voting. Members can vote on whether an application will be honored with the required investment. When done carefully, individual members and the entire community benefit from the CWP. It ensures a more robust local economy that can provide employment and social cohesion in the longer term. A prosperous local economy contributes to a thriving society, and there will be less economic migration from the community, with all the associated benefits.

- Pillar 3 – Future; The third part is intended for savings and investments. A risk profile is drawn up for each participant, to which the range of investment products will be tailored. Initially, the organization will introduce a limited number of products. However, we expect that once the value of the CWP has been demonstrated, outside financial institutions will be willing to provide products for this part of the CWP. It must be clear to all parties involved that it is only about saving and investing with a long-term horizon. We will coordinate with external financial institutions to only introduce products that embrace the philosophy of the CWP.

- Members receive support and training to get the most out of participating in the CWP.

- A “job bank” is set up for members to perform (paid) work. This concerns temporary jobs that can be carried out in addition to the regular position. The job bank cannot be used for recruiting staff or obtaining a full-time job. If a member cannot repay on time due to insufficient financial resources, the member concerned can appeal to the job bank. A fee is paid for all work performed, which can be used to reimburse the monetary reserve. Suppose more work is available in the job bank than members who need to use this opportunity to repay the loan. In that case, members can also apply for assignments to generate additional income for the financial reserve. It is expected that work will be offered on the job bank by the entire community. In this way, the whole community can be helped, both the provider of work because the work is completed and the person who performs the job because he can earn a supplementary income. We will start with that ourselves, hoping the community will see the benefits and follow suit.

- If a member does not comply with the agreements or abuses the financial reserve, a system of fines will come into effect, ultimately leading to the complete exclusion of the member concerned from the total program.

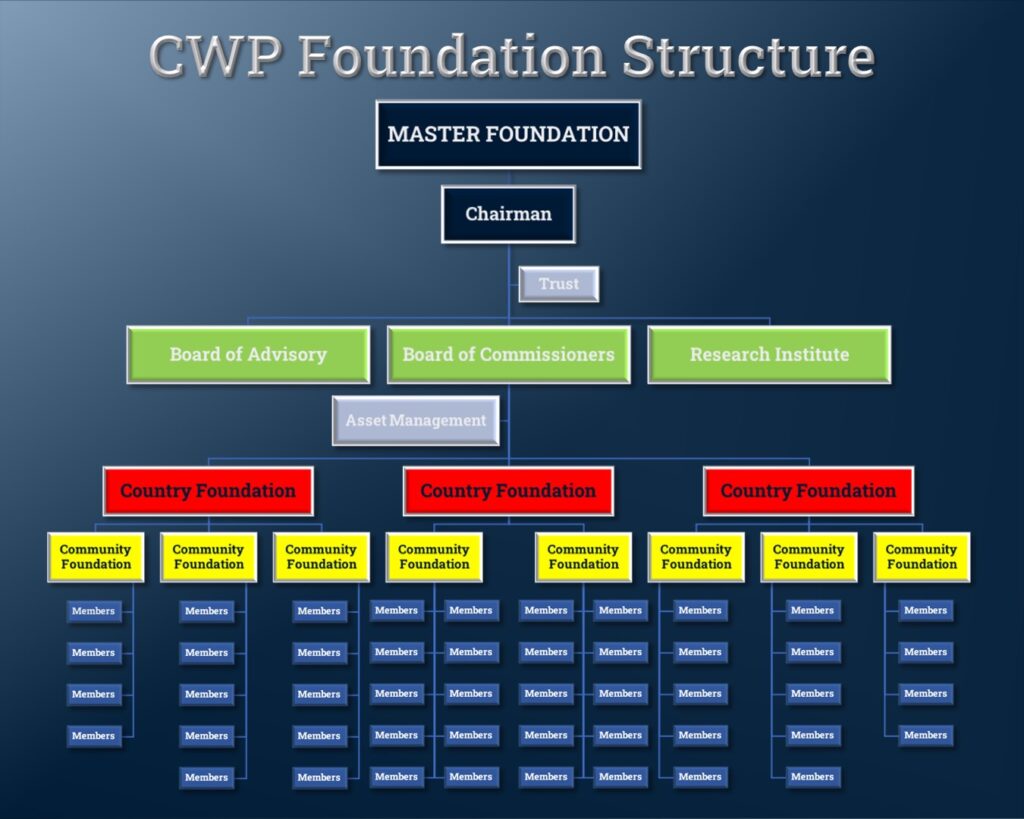

The structure of the Community Welfare Program Foundation

Master Foundation

We have opted for a foundation as a legal entity for the CWP. The Master Foundation is responsible for compliance with all (local) laws and regulations regarding the CWP. In addition, the Master Foundation must monitor the culture and guarantee the sustainability of the CWP. The master foundation is located in Indonesia; in other countries where the CWP will be active, a national foundation will be established that is supervised by the master foundation. The Country Foundation will be responsible for compliance with all locally applicable laws and regulations. For all operational activities related to the members of the CWP, local community foundations and associations will be established; the master and country foundations will direct all local foundations.

The master foundation is structured as a non-profit organization; the purpose of the foundation is to organize and supervise the Community Welfare Program. Program participants are the program’s beneficiaries but not members of the foundation itself. It is up to the foundation and its board to clarify the implications of participating in the program for participants, such as compliance with taxes and other laws and regulations so that beneficiaries are not affected. However, this does not mean that the foundation and its board are responsible for any beneficiary tax payments. It is ultimately the responsibility of the individual beneficiaries to make these tax payments. The foundation is responsible for informing the participants about laws and regulations and, where possible, negotiating with the various authorities when this concerns the entire program and all beneficiaries. In individual cases, the foundation can advise and instruct the relevant beneficiaries.

The master foundation is headed by the chairman and supported by the board of commissioners. The Chairman and Commissioners are appointed for at least four years. Qualified candidates can be nominated for the Chairperson or Commissioners position. The holders of the Utility tokens vote for the appointment of the Chairman and Commissioners. The chairman will lead a general board for all operational activities.

In addition to the organizational responsibility for the CWP, the master foundation is also responsible for the trust, and the Chairman of the Master Foundation becomes the trustee. The trust oversees the administration of the Utility Tokens and other financial resources allocated to the CWP.

The various structural components of the CWP and Master Foundation are described in more detail below:

Chairman

As described earlier, the position of chairman will have to be voted on. The founders will initially appoint the chairman, but after the first year, the Utility token holders can vote on whether the current chairperson can remain in office or whether the procedure is started to elect a new chairperson. We choose this structure because the Utility token holders contribute the capital to make all this possible. Transparency and accountability to the Utility token holders do not conflict with the independence of the CWP.

One of the essential tasks of the chairman is to make the CWP independent of the financial contribution of the Utility Token Holders as soon as possible. However, the CWP will never be separated from the Utility tokens and the holders. It is up to both camps to maintain a good relationship. Transparency and accountability continue beyond the relationship with the Utility token holders; it is only the first step in this process. The chairperson and the organization must publish annual reports and make them accessible to anyone who wishes this information. This will also help with the expansion of the CWP.

Herein lies another essential task for the chairman, stability and sustainability will contribute to the expansion of the CWP. The success of the CWP can be measured by the number of members who gain access to the CWP. The capital injections of the three financing rounds make it possible to onboard +5,000 members into the CWP. This will have to be done as soon as possible. But this is only a start; when these numbers are reached, it should not be considered a success for the CWP. Then it will only start; after this step, it will become clear whether the CWP can continue to grow without these direct capital injections.

It is up to the chairman and the team to introduce a plan for how the CWP can grow from 5,000 members to 100,000, 500,000, and ultimately the desired target of 1,000,000 beneficiaries. Then we can speak of success when these numbers are achieved. We need all parts of the entire project, including the Utility token holders. A well-run CWP organization is like cement between the building blocks and floors that keep everything together; that is another task for the chairman to take care of. The foundation and the chairman have nothing to do with Blockchain development or (new) business development activities. They should focus solely on the operational activities of the CWP and all aspects involved. But this should function like a well-oiled machine.

Another task is for the chairman as trustee of the trust that falls under the CWP; 21% of tokens intended for the CWP will be placed in this trust. These tokens do not go to the members but rather serve as a financial buffer for the long-term stability of the CWP. The chairman will lead this and ensure the tokens are well spent for the cause. The chairman will cooperate with his team to manage and spend the financial resources but will be responsible as a gatekeeper.

It can be a complicated situation for the chairperson, as incorrect spending of the tokens can directly lead to the dismissal of the chairperson while the chairperson is performing their duties for the CWP very well. But appointing an independent trustee is not an option, as the trustee can run his agenda and lose sight of the interests of the CWP. Ultimately, the tokens are destined for the CWP, and the chairman is always in contact with the token holders, so there is a direct line of communication. Ultimately, any spending of the tokens will be a joint decision between the chairman and the token holders.

Trust

The Trust is designed for the CWP to house the tokens and other financial resources intended for the stability of the CWP. These tokens do not directly accrue to the members, but any proceeds from sales, investments, and lending will go to the CWP and thus benefit the members. 24.5% of all tokens are destined for the treasury of the CWP; these tokens come in a trust agreement. The chairman of the master foundation is the trustee of the trust. The management and custody agreement (trust agreement) will contain clear guidelines for the chairman to work with. Initially, we will establish the trust and construct the trust agreement, but at some point needs to be ratified by the Utility token holders.

It should be clear that we must spend the tokens sparingly. These tokens are intended to ensure the long-term stability and continuity of the CWP. Issuing the tokens directly affects the vulnerability of the CWP. The Utility token holders have a direct role to play in this; it is in their immediate interest to handle the contents of the trust with care. Everyone should know that the sales of tokens can only be made once. It should be possible to issue tokens of the trust under stringent conditions, and even then, caution is advised.

There are other options to make the tokens in the trust profitable for the CWP. Third parties can borrow the tokens, provided sufficient collateral is provided. The tokens can provide enough liquidity on various exchanges and many other options. We propose that there are clear guidelines for the administrator/chairman and an ongoing clear risk profile with which the token holders can make decisions. In addition, the token holders must always give prior permission when selling tokens.

Regardless of the activities, it should be clear to everyone that the proceeds of all activities in the trust will have to go entirely to the CWP. No remuneration for the management of the trust will be paid, and no costs for third parties can be reimbursed from the proceeds of activities within the Trust. Only an exception can be made for direct transaction costs. But if a third party wants to use the tokens for lending, all transaction costs must be passed on to the third party. The master foundation will bear costs incurred by third parties for advice or the like, and the company will pay these costs in full for the first two years.

As soon as the issuance of the tokens takes place and the Waqf has been drawn up, all documents regarding the Waqf, management of the tokens, and mandate of the trustee will be translated and published for the token holders. The trust will be structured according to the laws and regulations of a Waqf (Wakaf); this is an official construction within Indonesian law and has a straightforward tax-technical approach. In a separate report, the functioning of the Waqf and possible differences with the trust in other jurisdictions will be discussed in more detail and a clear explanation from our side of why we have chosen the construction of a Waqf over an Anglo-Saxon model of a Trust.

Board of Commissioners

The Board of Commissioners has a dual function; firstly, the board holds a supervisory role; they control the chairman and the general management. Secondly, they also have an advisory and supporting role for the chairman, general management, and all operational units within the foundation and sub-departments. They see to it that the chairman and the general management perform their duties according to the mandate given to them by the foundation and the Utility token holders.

The Board of Commissioners will initially have at least three seats. However, it can be extended to a minimum of five seats, with the founders reserving the right to designate a minimum of two. The commissioner’s appointment is for four years; if deemed necessary for the stability of the CWP, the commissioner concerned may be re-elected for a new period of four years.

At least four times a year, the board, including the Board of Commissioners, must meet to discuss the complete state of affairs regarding the CWP. A joint report of these meetings will be submitted each calendar quarter to the token holders. Independent of the Chairman, the Board of Commissioners must prepare an annual report and present it to the token holders. Following this report, the token holders will have to vote on the functioning of the Board and its commissioners.

The founders believe it is in the interest of a well-functioning and supportive board of commissioners. Therefore, they deem people with different expertise necessary for a board position. In any case, at least one commissioner must have a legal, financial, or business background. In addition, the board of commissioners must also install a body that supervises the trust and asset management activities. These bodies directly inform the supervisory board, after which the board of commissioners reports to the token holders. The chairperson of the master foundation cannot exercise any influence over the content of these reports.

Board of Advisory

An advisory board will be established, but this council will not have an official function in the foundation’s policy and its components. The advisory board aims to collect specific information to help with the policymaking and execution of day-to-day activities. This can be advice on all fronts that the Chairman and the Board of Commissioners believe will be necessary to inform better the token holders and the public about the state of affairs. The CWP deals with complex matters and will not have all the knowledge required to formulate certain decisions and propose them to the token holders. But also, with the execution of the CWP and the members, an advisory board can ensure enough knowledge available to make the project successful.

An example of where the advisory board can make a substantial contribution is the complexity surrounding the financial illiteracy of most members of the CWP. How can this be improved, and what can be done structurally to prevent this? If the foundation doesn’t deal with this properly, there can be a risk that the turnover of members will be huge. The members will not immediately understand why all activities within the CWP are necessary. People will want to gain personal economic advantage from it but will try to ignore all other things as much as possible. If this problem is not recognized and addressed sufficiently, we are no better than all other well-intentioned initiatives. Then the project will eventually end in a fiasco.

Research Institute

There will also be a research lab under the Advisory Council, where collaboration with colleges and universities can be ratified. The importance of this collaboration lies in the fields of data collection and education. The results will help the CWP’s operational activities and game development. Games can help speed up project customization among members. The whole community will surely benefit from this.

Here is a world to win. As part of the research institute, a separate department will be set up to investigate the possibilities and impossibilities of Islamic financial protocol in modern economic systems. What is the meaning of all the jurisprudence surrounding this subject, and how can we apply this in blockchain and crypto? How can we make these traditional protocols applicable in defi and blockchain? These protocols can bring more benefits to the community and its members than it will bring harm. But this will have to be researched and, where possible, assessed academically. What can we learn from it, and what might be better not to make it applicable? No one can give an unequivocal answer, but it could help the entire crypto community.

Asset Management

This will be the asset manager for the funds of the CWP and BDF; the asset manager falls directly under the foundation’s chairman. They do not make policy themselves; they are implementers and must exercise a high degree of prudence in the performance of their activities. The asset manager cannot make and implement decisions unilaterally but can advise the chairperson. The chairperson, in turn, will have to seek advice from the Board of Commissioners and the token holders before this advice can be adopted or set aside.

The asset management department is appointed to develop a standard risk profile model for the members of the CWP. In addition, the asset management must compile a portfolio of savings and investment products from which members can choose to use under pillar three of the CWP. These may be products developed by asset management or composed of offerings from third parties. A third-party product can only be offered when complete research has been done by asset management and finally approved by the entire board of the foundation.

In addition, the asset manager will have a role in evaluating financing applications for the second pillar. The asset manager will be asked to assess whether it will be viable. It is not necessarily binding advice, but at the very least, it must be a substantiation where a possible financing application falls short.

Country Foundation

If the CWP expands its activities to other countries, then the management in each country should establish a foundation. All activities in that country will fall under this entity. The country foundation is responsible to the Master Foundation; the country foundation is obliged to adhere to the policies and guidelines set by the Master Foundation. Adjustments can only be made when necessary due to local laws and regulations. Every country foundation must take care of local fundraising. They will have their country-specific community token at their disposal. However, the monetary policy for that community token will be dictated by the master foundation with the support of the Asset Manager. Circulation and price strongly depend on the local situation.

The country foundation and local chapters will have full access to all facilities of the CWP, and their members can use the marketplace and job bank. The community tokens are exchangeable with other country-specific community tokens; acquiring products and services from other communities should be possible.

Community Foundation

Each department of the CWP will have a work unit responsible for carrying out all operational work related to the members. They will have to make members aware of all the possibilities of the CWP and the responsibilities of the members. In addition, the local chapters will have to provide courses where members learn to deal with all facets of the CWP. This can be in groups but also personal classes. Especially in the beginning, it will be more proactive in guiding the members, with a more passive and supporting function later in the background.

The work units are organized as a department and do not have to be entities. Depending on the membership size, a foundation or association is established per region, positioned under the Master Foundation or a Country Foundation. This regional entity is an executive body and cannot independently implement or change policies and procedures; this remains the sole responsibility of the master foundation.

Frequently Asked Questions:

Why a community-oriented program and not an initiative aimed at individual members?

Because we rely on the power of group dynamics, the overall program includes components based on the individual but is not exclusively individualistic. Within a group, people can support each other and discover the possibilities of the program together. There is nothing wrong with doing things together. We hope for a dynamic in which the group comes closer together, stands together for a specific goal, and strives for it.

We hope there will be a natural process of social control among the concerned members of the community. This process can have a curative effect if one of the members wants to avoid following the rules for participating in the program. Members will support and assist each other if a particular member is in danger of losing their membership in the program.

The CWP has families within a particular community as members; are single-person households excluded from participation?

Here in Klaten – Indonesia, where the CWP kicks off, the choice is made to make families the members/beneficiaries of the program. This is done because every household is registered as a family (Kartu keluarga). Single-person households also form independent households and are therefore considered a family. But to avoid further discussion, it should be clear that a group can be composed in whatever way is thought best for all participants within that group. Suppose it is decided elsewhere not to put together a group of members within a fixed living environment but to select the participants based on other characteristics. That is possible as long as a group of at least 25-40 individual members is formed to get the most out of the group dynamics.

A conscious decision was made to choose for all families within a specific neighborhood community in the group’s composition and not to opt for a group composition according to strict preconditions. You automatically get a greater diversity within a particular group, variety in:

- Family composition

- Age

- Income

- Knowledge and experience in the field of education and employment

Strict parameters in the group composition can lead to a high degree of homogeneity from which the participants cannot easily escape. It is motivating if positive examples can be found in the immediate vicinity. The whole program risks its goal of getting a better future financially, mentally, and physically (health) when there is too much homogeneity in the group composition.

The CWP provides credit; credit is debt. Does that not violate the purpose of guaranteeing participants a better financial future?

The financial reserve is provided to all participants through revolving credit. It is an interest-free form of credit with an emphasis on agreements. Agreements about repayment and frequency. These are the conditions for using the budget under Pillar 1.

We want to avoid reducing budget spending to a one-off event. People will likely find short-term satisfaction from one-time spending because a significant amount wasn’t available before, but that’s about it. How different is this if the budget remains intact and usable for members when needed? Structurally nothing changes, and it has little or no effect.

The program aims to provide the beneficiaries with a better financial future; this goal cannot be achieved if it is a one-time donation or if the program is temporary. Once a member has been allocated their budget within the program, the total amount under Pillar 1 is available. The organization or any other outsider cannot take it away. However, when a member refuses to abide by the terms of participation in the CWP or misuses the program in such a way, participation in the CWP may be terminated, and the member concerned will lose access to the facilities of Pillar 2 and 3.

All families in a given community automatically become members of the CWP, but what if a family does not want to participate in the program?

The budget for all members is available; it is the free will of all members whether they want to use it. Only if a member indicates that he does not wish to participate will we ask permission from the member concerned to make the part of the budget intended for Pillar 2 available so it can still be used for this purpose. Any return on investment is added to the member’s financial reserve.

Should a member who initially opted not to participate in the CWP change their mind, they may begin to join at any time. The budget is allocated to all members, and whether they want to use it at the start or after ten years remains the same possibility of participation.

Is participation in the CWP indefinitely, or are there options to terminate participation early and have the principal paid out?

There have yet to be any concrete plans, but we are toying with offering 10% of the participants the opportunity to end their participation every year. The idea is to choose a fixed time each year at which the request to cancel the membership can be submitted. After this period, a random selection can occur, whereby, for example, members who can stop participating in the program are chosen under the supervision of a notary. Or we can opt for a first in, first out model when requesting termination. The first person to submit the request has the best chance of ending.

However, the 10% also includes the number of members whose membership is terminated for malpractice or negligence. In the event of the death of one of the members and if no heirs are living in the community, the participation in the CWP is terminated, and the budget of the financial reserve, after deduction of any costs, goes to the legal heirs. In addition, it must also be considered that a family can move out of the community; if the new living environment does not yet participate in the CWP, participation will also be terminated if the whole family moves.

If a transaction occurs due to the above cases, it will be done in crypto tokens. It is up to the member concerned about what he wants to do with the crypto coins. But it should be clear that they can no longer count on further involvement or support from the CWP, and the member concerned will have to manage his tokens himself. The Member can sell their Tokens to the Organization or other suitable candidates upon termination.

Summary progress developments of the CWP

The changes/additions we have made so far from the original plan are twofold: we’ve developed a framework for the CWP that won’t change much, although we’ll always keep working on the details to improve it. The program will be continuously tested on the user experience of the members.

- The original plan assumed that new members would be given a certain amount of crypto tokens. We will not change this plan, but a separation has been made between the Utility- and Community tokens. The new members will be assigned community tokens, which can only be used within the program, or they can be used to purchase products that we offer in the various online stores, possibly later in physical outlets. Members are no longer allocated Utility tokens. The conversion rate of the Utility token will be volatile, especially in the initial phase. Determining the fixed conversion rate and how many tokens should be allocated to each new member is impossible. In addition, the price value of the Utility token will have much lower value from the start than, for example, in 5 or 10 years. This would mean that the first members will be allocated a disproportionate number of tokens in the longer term; more on this topic in the next chapter of this project paper.

- The “job bank”; After frequent consultation with experts, we realized we needed to develop an opportunity for members to create a revenue model for the monthly repayments on their credit reserve. Most members’ current monthly or annual income does not allow them to repay borrowed amounts within the foreseeable future structurally. The most important thing is that, despite a possible lack of financial resources, members can still fulfill the agreements when withdrawing an amount from the personal credit reserve.

Initiator’s Note: We can give away an amount and see what everyone does with it. However, several (pilot) projects show that this will have little effect on the financial position of the beneficiaries in the longer term. We have written about this in the project documentation, [5] where the reader can find links to various reports on the subject. Partly as a result of these investigations, we have been strengthened in our plans for a personal credit reserve. But then we come to the next point when the members want to withdraw a significant amount from the personal credit reserve. One-third of the total amount is intended for the personal credit reserve. That is an amount equal to 67% of the average annual income. What is a reasonable period within which the amount must be repaid?

A small calculation:

Personal credit reserve: Rp 120.000.000

Average annual income: Rp 60,000,000

1/3 of the personal credit reserve: Rp 40,000,000

The disposable annual income of Rp 60,000,000 is Rp 5,000,000 per month, repayment scope of a maximum of 10% of the monthly salary, or Rp 500,000

Rp 40,000,000 / 500,000 = 80 months, or 6.6 years.

For indicative purposes;

The rate of the Indonesian Rupiah at the time of writing this blog is:

USD 1.00/IDR 14,500

EUR 1.00/IDR 15,300

It is up to the reader to judge whether this is reasonable and whether strong member engagement for the CWP will continue under these circumstances. If we left it at that, we would not offer a solution but a burden for the participants. Another factor is taken into account in the creation of the CWP. There is a powerful urge within the community to generate additional income. Nearly one in three families have activities at home to create extra income. The fact that this does not lead to structural successes that should give most families a better financial future is due to one main reason: the need for start-up capital or investment capital. That is, of course, not the only cause but the most crucial cause. With the second part of the personal credit reserve, we have already primarily addressed the problem of seed capital or investment capital.

Only some have a creative plan to generate additional income. Hence the job bank. In the beginning, this part will require much attention, like everything within the CWP, but it will be almost automatic in the long run. While we will have trouble finding enough paid work that members can perform initially, it will come naturally in the future. Because the job providers will also see the benefits, one of the rules when providing financing to entrepreneurs may be that they submit tasks/jobs to the job bank. As we have discussed before, the CWP should not only help the individual members but also strengthen the community; this is one of the parts that can help.

In addition, if the entrepreneur provides work for the job bank and the members carry out those tasks, it increases the involvement in the investment on both sides. It is up to all members to take these opportunities seriously. Whether they do the work themselves, with the whole family, or individually, it is up to the members to decide. We only provide guidance and insight into how members can improve their financial position in the longer term.

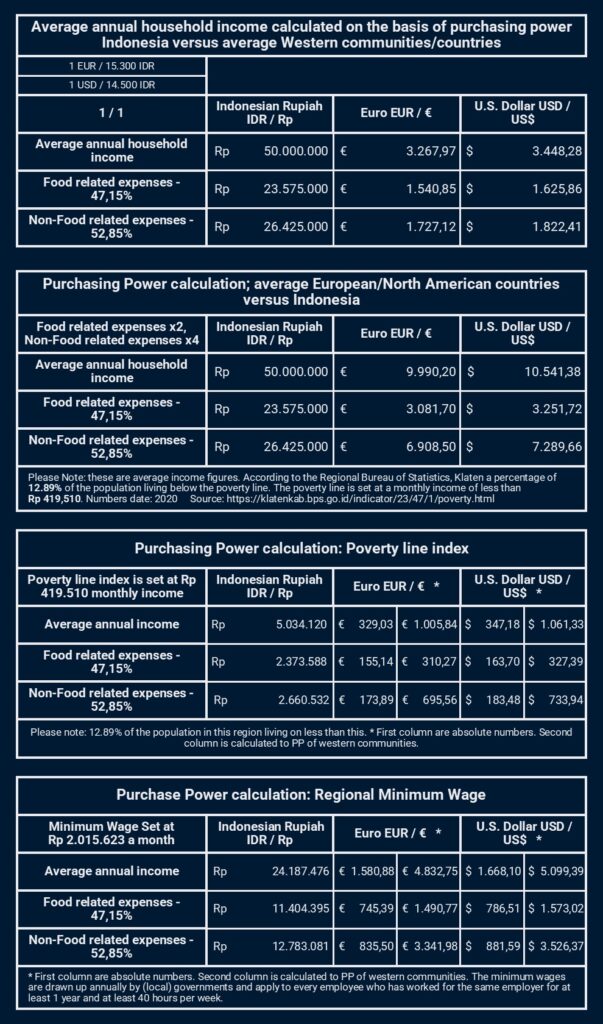

We ask the reader to put themselves in the situation of the members of the CWP; we are here not talking about people who have sufficient opportunities to realize a better financial future independently. For convenience, we calculate an average annual income of Rp 50 million. That sounds a lot by Western standards, but let’s put that in cold numbers:

Whether these figures give any impression is for the reader to judge himself. Nearly 13% of the population living below the poverty line is alarmingly high. It should be added that these figures only refer to individuals aged 15 and over. So if the youth is added to that, this figure will be even higher. Less than $329.00/$347.00 per year is shockingly low. In 2022, more than 158,000 people will have to live on less than such income in this region. That’s just one region in Indonesia; in the whole province, we are talking about more than 4 million people; knowing that the island of Java is the most prosperous part of Indonesia, what about the rest of the country?

Of course, Indonesia is not the only country where poverty and the wealth gap are a problem; it occurs worldwide. But we live here, and we are confronted with issues daily, and that’s why this made us think. What can be done so that everyone benefits from participating in the CWP? We would like to see this initiative also taken up by others and rolled out further in the area where they live. We develop the infrastructure of the CWP, everything is documented, experiences are shared, and we are ready to support anyone who wants to roll this out in the community they see fit.

With this, we’ve covered most of what needed to be discussed about the CWP. We are still debating the proper legal structure; this discussion mainly concerns the local departments. To arrive at a definitive form, we remain dependent on the laws and regulations in the country concerned. We will continue to publish about this and share our experiences.

The next part of this blog article is about blockchain technology, (sub)networks, and crypto tokens.

[5] https://www.emcebe.com/project-2-community-welfare-program/

Part 2 Blockchain and Crypto

Are Blockchain Technology and Crypto Tokens Necessary?

The question will always be asked whether blockchain technology and crypto tokens are necessary to realize this project. The project relies on blockchain as an infrastructure to ensure absolute transparency and independence for all participants. The initiators are convinced that there is no better way to implement the project than by using blockchain technology and crypto tokens.

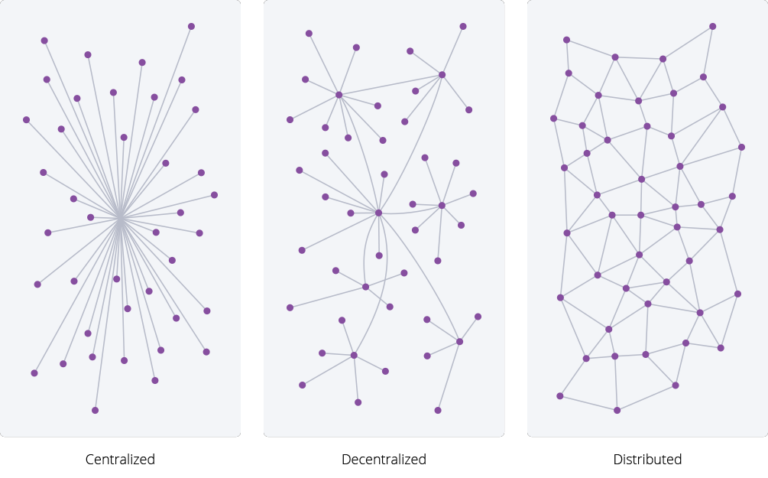

When we talk about Blockchain, we mean an automatic, decentralized, and secure system for gaining and giving trust. Trust what is based on Distributed Ledger Technology, i.e., on a registry distributed across the various network nodes and structured as an immutable Blockchain. The distributed network of nodes also verifies transactions through a process known as Mining for a Proof of Work (POW) protocol and Validating for Proof of Stake (POS) protocol making the Blockchain technology a Trustless (Trustless) system.

With blockchain, the transaction history is permanently recorded and available to the user. Once registered and validated in a ledger, the data cannot be changed; blockchain does not allow changing or deleting information. This is crucial for all users of the network but also any third parties. Consider government agencies a user may have to deal with and possibly institutions in the traditional financial world (TradFi), such as banks and insurance companies.

The project develops an extensive network of users who form sub-networks. Everyone within those networks must be able to rely on each other without abusing individuals or networks. The users are independent of one or more individuals (intermediaries); therefore, a high level of fairness remains between all players in this extensive network; small or big doesn’t matter anymore. That is why blockchain is needed, not as a stand-alone network but as the infrastructure that connects all sub-networks and allows them to communicate.

Therefore, the project needs blockchain as a critical component for successfully implementing the whole. All networks are communities of individuals connected for one reason or another. They are communities with and without physical geographic boundaries. The overall project has no geographic footprint, as anyone can decide to be part of the main network, the main chain of the blockchain network, in any way they choose. The subnetworks, or side chains for the CWP, have geographic boundaries due to the characteristics of the CWP, but that does not mean that “outsiders” are excluded from interacting with those networks.

In the interaction between the members of the different sub-networks and the leading network, crypto tokens play an essential role. In addition to all the usual functions anchored in a crypto token, it also contains a means of communication between the various networks and the outside world. Within the project, each blockchain network has its token, be it the main chain or a sub-chain in the blockchain. The ideal model for this project will use the leading network (main chain) with multiple sub-networks (side chains). From the start of the project, two sub-networks will be used.

The main network is what it’s all about, the engine of the whole project. Within the main- network, we have two sub-nets; all communities and activities within the CWP are housed on a sub-net, and we also have a sub-net for gameplay and education. The specific sub-net for the CWP hosts all activities related to its members. Each region or country has its community with a corresponding token within which all activities can be developed. Each regional community token has its specific characteristics.

The community tokens can only be used within the relevant subnet and are not freely tradable outside the subnet. However, the various community tokens are freely exchangeable for other community tokens. This simplifies purchasing products and services from different communities within the CWP Network. The prize value of a community token is related to the fiat currency value of the country where the community has its physical footprint. For example, from the beginning of the CWP, this community token is valued at 1,000 Indonesian Rupiah. The founders have chosen this to allow users to get used to and accept it more quickly. In Egypt, where the project will establish the first land foundation, the community token will have the same value as the local currency one-to-one.

The most significant change from the original plans

With the above, we immediately come to one of the most significant changes from the original plan, from one to multiple crypto tokens. Initially, the intention was to work with one crypto token and teach the users how to deal with blockchain and crypto. But the biggest obstacle was the valuation of the tokens because working with one token creates the possibility that the allocation of tokens, especially in quantity and value, becomes unbalanced with what previous members have received.

Another advantage of working with multiple tokens is that the tokens also reflect a specific identity. Not an individual identity but a group or community identity. Because the users have access to different tokens, it is immediately apparent in which community the relevant activities occur. This can undoubtedly increase the involvement of the users in their respective communities. In addition, it makes clear what a token can be used for. While the various community tokens will mainly be a means of payment and usage, the Utility-token is mainly the token that guarantees the stability of the whole project and can be seen as a store of value.

The project has multiple user groups that want to pursue their objectives; if we separate them, the interests of the groups won’t conflict, and the group dynamic may be protected. Through the CWP, we have a group that becomes the native users of the entire network. In addition, we have a group that makes the whole project possible and mainly benefits from the stability of the system and the further growth of the possibilities and user groups. Let’s distinguish the groups and outline their objectives:

- Utility Token holders: With the purchase of tokens, the token holder provides liquidity to the system as an essential contribution to the stabilization and continuation of the project. In return, the token holders get voting rights in the policy and future development of the project. With this voting right at their disposal, token holders remain in control to prevent the evaporation of the capital base, and they will be strongly motivated to realize (controlled) project growth.

At the same time, security and decentralization will be the key components to ensure system stability. The role of token holders is decisive in this. The network of token holders maintains the nodes and plays a vital role in token staking, assuring fairness in validating transactions and creating new blocks in the chain.

- Members of the CWP: Members receive community tokens by participating in the CWP. This makes them the native users of the entire platform. Due to the objective of the CWP and the three pillars, the members naturally become the economy’s driving force within the whole project and, thus, regular users of the main network and sub-networks.

However, the economy within the project is one of many economies in which the members participate. They have one foot in the project and the other in the traditional economy of the living environment. That is one of the reasons why the project ensures that the value of the community token reflects the fiat currency in the mainstream community. This makes it relatively easy for the participants to compare the value of products and services with comparable products and services outside the project in mainstream society. This accelerates the acceptance of community tokens by the members.

The question remains, how can a system be developed in which both parties remain satisfied?

Stability seems to be the keyword, but this is more utopia than realism within the market dynamics. What we don’t influence is investor sentiment in an open market. Still, we should not blindly accept such a fact and blame the market when it shows unwanted price movements. A lot can happen during a hype. We will always have to play our part in this, never making statements about future price developments. We are not allowed to contribute to maintaining the hype. It’s not to our advantage; lows often follow highs in the markets. We should always strive for stability and transparency.

In general, what is the reason why extreme price swings often accompany crypto tokens? Imputed value over intrinsic value, the trend in the market is that speculation is mainly driven by imputed value. Because no intrinsic value can be given to a protocol or because people need to learn how to calculate it, trust is often wafer-thin. Every rumor is answered. This is not a new phenomenon; once speculators enter the commodities markets, you see this happening again and again, but also in new markets; it is a phenomenon that the market has to go through, and Blockchain and Crypto are such new markets.

The most important thing we can give to the project that can be considered intrinsic value is the number of native users. There is no doubt about this; there are more suitable candidates to join the CWP than we can ever serve, which will be fine. But how do we scale the project so it becomes a project that will make a difference? As the original plan described, with one token, this was impossible; we would depend on that token’s value to do this properly.

We propose splitting the different target groups to solve this problem. Both get their specific token; there will be a Utility token for the supporters of this project; for the participants of the CWP, there will be a community token. However, not both tokens are freely tradable. Only the Utility token is freely tradable. The community token is awarded to the members of the CWP, or one can buy the community tokens with the Utility tokens. So if non-members want to own the community token, for whatever reason, they will have to exchange Utility tokens for community tokens. The capabilities of both tokens are described below.

Utility Token

This token matters in this system; transaction costs can be paid with the token, and decentralization and security can be achieved by deploying these tokens. But it is also the right means for the token holders to let their voices be heard. The token holders can have a say in the policies of the platform.

Description of Utility Token:

Utility tokens are a distinct category of cryptocurrencies. Unlike coins and security tokens, utility tokens provide users with dozens of features on blockchains and dApps (decentralized applications). As smart contract blockchains like Ethereum continue to scale, more blockchain developers are issuing unique utility tokens for their Web3 projects.

Now that more cryptocurrencies are available on exchanges, many investors ask themselves, “What is a utility token?” Why is it so significant to distinguish utility tokens from other types? Are there legal implications to separating utility tokens from other crypto projects?

What is a Utility Token?

A utility token is a cryptocurrency on a smart contract blockchain that serves a specific function in a crypto project’s ecosystem. Unlike cryptos like Bitcoin (BTC), utility tokens aren’t designed to be a real-world medium of exchange. Instead, a utility token only has a use case within its respective smart contract protocol.

Most often, utility tokens aren’t mined into existence like Bitcoin or Litecoin. Instead, Web3 project leaders “pre-mine” [6] their utility tokens and send them to team members, early investors, and the general public.

Any crypto project can release utility tokens on a smart contract blockchain to grant users access to special features. For instance, utility tokens can be used to purchase in-game items in metaverse titles like The Sandbox. Some utility tokens like Uniswap’s UNI may grant holders voting privileges on a dApp.

The point is that utility tokens only serve a function within their respective ecosystems. While utility tokens have monetary value in the open crypto market, they aren’t trying to be a medium of exchange, an inflation hedge, or a long-term store of value. Instead, developers create utility tokens to drive growth and engagement or raise funding for their dApps.

[6] minting is the process of generating new coins using the proof-of-stake mechanism and adding them to circulation to be traded. More on this: https://coinmarketcap.com/alexandria/glossary/minting

What are the primary uses for utility tokens

There are dozens of possible use cases for utility tokens. A few common ways people use utility tokens include:

- Voting: Utility tokens give people the right to vote on upcoming improvement proposals on a dApp. Technically, if a utility token gives people this privilege, it’s known as a “Governance token.” While every dApp has different rules for blockchain governance, one of these tokens typically represents one vote.

- Gaming: Many blockchain-based games have utility tokens that can be used to buy in-game items like NFTs (non-fungible tokens). Also, these utility tokens often serve as a rewards mechanism in play-to-earn games like “Axie Infinity.”

- Crypto exchange perks: Some centralized crypto exchanges (CEXs) like Binance, KuCoin, and Crypto.com offer utility tokens to reward holders with perks like discounted trading rates.

- Tipping: Utility tokens may serve as a dApp’s built-in tipping mechanism. In addition to rewarding content creators, this function may influence the ranking of comments or videos on a social media dApp’s main page.

- Paying network fees: People must pay transaction fees using a smart contract blockchain’s native utility token. For instance, people who want to use a dApp on Polygon must use the MATIC token to confirm transactions.

What do ICOs have to do with Utility Tokens?

Utility tokens were only possible after the Ethereum (ETH) blockchain began operations in 2015. Ethereum was the first project to introduce smart contract functionality, which refers to coded commands that use “if/then” statements to perform automatic tasks on a blockchain. All utility tokens live on smart contract blockchains, and many of these cryptocurrencies use Ethereum token standards like ERC-20.

While utility tokens were around before the 2017 bull run, they gained mainstream prominence during the “ICO craze” of 2017-2018. During this time, hundreds of new Web3 projects began offering initial coin offerings (ICOs) to investors to raise funds.

Many of these ICO companies claimed they were selling their “utility tokens” to early investors. However, in reality, most of these tech start-ups had no intention of providing token holders with utility. Indeed, developers typically used the “utility token” label to evade sanctions from the U.S. Securities and Exchange Commission (SEC).

As authorities caught wind of the many scams in the ICO space, they began drawing more precise distinctions between utility- and security tokens. To qualify as a utility token, a cryptocurrency must provide a viable use case beyond mere speculation. Valid utility tokens also can’t be connected with partial ownership in a company or third-party endeavor.

In contrast, a security token represents partial ownership in a third-party enterprise. For instance, a security token would be a token that tracks the price of Amazon’s stock. Also, innovative trading platforms offer security tokens representing partial real estate ownership.

Since security tokens are defined as “securities,” they must register with the SEC. Utility tokens, however, don’t need SEC approval to list on crypto exchanges.

Governance Token vs. Utility Token

A governance token is a utility token that allows investors to vote on proposed changes to a dApp. Developers usually publish improvement proposals in a smart contract and let the community vote by staking their governance tokens. Once the voting period ends, the smart contract automatically tallies the vote and records the results on the blockchain.

Other than voting rights, governance tokens share other utility tokens’ traits. Indeed, most governance tokens have many non-governance-related uses in DeFi. For example, people who hold Uniswap’s UNI tokens can lock them into a liquidity pool and earn a percentage of transaction fees.

All governance tokens are utility tokens, but not all utility tokens are governance tokens. If a utility token doesn’t give holders a say in blockchain governance, it’s not a governance token.

Is Bitcoin a Utility Token?

Bitcoin isn’t a utility token. In fact, Bitcoin isn’t a “token” at all.

The term “token” only refers to a digital asset created for a Web3 project on a pre-existing blockchain. In contrast, “coins” are cryptocurrencies native to their blockchain and function as a medium of exchange. Other prominent “coins” in cryptocurrency include Litecoin, Dogecoin, and Bitcoin Cash.

The SEC and the U.S. Commodity Futures Trading Commission (CFTC) have repeatedly said Bitcoin is a commodity. Therefore, Bitcoin falls under the CFTC’s jurisdiction.

Are NFTs Utility Tokens?

Although many NFTs are no more than digital collectibles, more creators are adding use cases to their NFT collections. Yuga Labs’ Bored Ape Yacht Club (BAYC) NFTs granted holders access to VIP events like “Ape Fest” and members-only websites like “The Bathroom.” As the BAYC grew, Yuga Labs offered valuable crypto airdrops like Mutant Serum NFTs and APE tokens to people who held their BAYC NFTs.

There are also many companies and celebrities experimenting with high-utility NFTs. For example, the Kings of Leon was the first band to release a new album as an NFT. This band also released special “ticket” NFTs that grant holders access to VIP concerts.

Although NFTs aren’t inherently utility tokens, developers can find applications.

Utility Token examples

To better understand what sets utility tokens apart from other cryptocurrencies, it can be helpful to run through a few examples:

- Smooth Love Potion (SLP): SLP is a central utility token in Axie Infinity. Players can earn SLP tokens for winning battles and completing quests with their animated “Axie” monsters. Gamers can also use their SLP tokens for breeding or leveling up their Axie NFTs.

- LINK: Built on Ethereum, Chainlink is the largest decentralized blockchain oracle. Anyone using Chainlink’s Oracle services must pay transaction fees with its ERC-20 LINK token. These LINK tokens also serve as a rewards mechanism for Chainlink’s node operators.

- BNB Coin: Released by the CEX Binance, the BNB Coin initially gave Binance customers discounts on trading fees. However, now that Binance created its BNB Smart Chain, people can also use the BNB Coin to pay for gas fees on dApps like PancakeSwap.

- Basic Attention Token (BAT): BAT is an ERC-20 cryptocurrency on the dApp-friendly Brave Browser. The Brave team wants to use BAT to revolutionize online ad incentives. Brave users can sign up for BAT rewards and receive monthly payouts depending on how many ads they view. People can also use their BAT to tip advertisers they like.

Wrapping up

While investors can buy utility tokens for price speculation, it’s not the purpose of these cryptocurrencies. Utility tokens are designed to be used on their respective protocols. From gaming and voting to tipping and transaction fees, utility tokens should always serve a function in their expanding Web3 ecosystem. [7]

Why a Utility token for this project? Because this token will not simply have to take on one role but has to serve multiple functions. This is a token that its versatility in use will characterize. This token will build bridges between the different communities and their use of the subnet and activities on the main net. The utility token’s role is primarily the token that takes care of the transaction costs. With this token, all transaction costs for the entire network can be covered. At the same time, this token will reward those who validate transactions, provide the network with stability and security, and provide the desired decentralization.

One of the many reward functions housed in this token is influencing the project’s future. This token will also serve as a reward function for those who help develop applications and thus increase the user-friendliness of the project. Then we need to mention another role that comes with owning this token. We have already said that the token will reward everyone contributing to the project and the applications. But the importance of the token is much greater. Anyone who owns this token at any point has a role in the project.

Whether it is someone purchasing the token and seeking speculative purposes for it in a DEX outside the project, the role it serves the project is that of liquidity. If the liquidity is in balance, this ensures the project’s attractiveness. Suppose someone uses that token as a store of value and stores this token in, for example, a hard-wallet or cold storage. In that case, that person deprives the project of volatility and thus ensures a more stable price value of the token, which can be anticipated in the longer term.

Token staking plays a vital role in the project. The token can be used in staking for transaction validation, staking for liquidity, or depositing for voting rights. It doesn’t matter much what the purpose of the staking will be; everything will impact the project’s success. Most importantly, they should feel comfortable with whatever role a person takes.

[7] This description of Utility tokens comes from the following article: https://worldcoin.org/articles/what-is-a-utility-token

Community Token

We opt for an unusual solution here with the choice of a community token. Community tokens are a form of social tokens, although our token, in its pure form, will become an actual community token. It took a lot of thinking and resilience to come to this solution. In retrospect, we are happy with the possibilities this can bring. We recommend reading this article to understand social tokens’ different forms and capabilities.[8]

The members of the CWP are allocated an X number of tokens at the start. The currency value of the Community Token will bear some recognizable resemblance to, although not necessarily a direct reflection of, the locally used fiat currency. Take Indonesia as an example; the value of the local community token is set to 1 community token / 1,000 Indonesian rupiah. [9] [10] We base the value of the community token on the value of the local currency because the members of the CWP all live in an area where that specific fiat currency is used in everyday situations outside of the CWP. This will strengthen the acceptance of the community token. This is not so much applicable to non-CWP-related users of the token, but they will likely use the token to purchase products and services from that region. These products and services are produced locally, so using the local community token for transactions makes economic sense.

The Community Token is only circulated within the CWP subnet; when a transaction occurs outside this network, the community token must be exchanged for the Utility-token. Suppose a member wants to withdraw some funds from their credit reserve and convert these tokens into local fiat currency. In that case, the community tokens will be exchanged for Utility-tokens, which can be exchanged in the desired fiat currency. Or, one of the members wants to transfer to their credit reserve, but they need community tokens at their disposal. In that case, they must first have Utility-tokens purchase community tokens to complete the transaction to their credit reserve. Activities within the “job bank” are paid for in community tokens. The work provider must first have Utility-tokens to purchase community tokens to spend on the job performance.

The community token can be used for multiple purposes; the community token can be used in marketing campaigns for community-related activities. It is an excellent resource for various loyalty programs to reward community members for services rendered and loyalty to the system and project. Of course, the token is also the means of transaction for the marketplace and other ways of interacting with the outside world. And there are many more things the community token can be used for. But above all, the community token is the token on which the community economy runs. Without a thriving economy, community cohesion will rapidly decline. The community token is the most suitable means to engage and connect everyone within the community, with no laggards, all winners, and moving towards greater equality.

Above, we explicitly wrote the entire community, not only the community in which the CWP is rolled out but also the community of Utility-token holders. Both groups will use the community token’s capabilities in an ideal world. The project is more than just the CWP and the opportunities available to its members. It is also the business activities that are part of the whole project to be the first to generate the cash that the CWP needs for its members. The products we will produce within those activities are products everyone can benefit from.

Then there is another aspect of community tokens that is little discussed as it can have positive and negative aspects. That is the form of identity associated with the community token. A community token is not resistant to censorship. Everyone immediately knows which community someone belongs to if they wish to receive specific community tokens for whatever reason. In the interaction between the different communities, situations can arise where one community no longer wants to engage in activities with the other; this can be achieved simply by banning a specific community token. An unlawful act by one of the community members can have negative consequences for all members. This is one of the reasons why we want sizable communities, communities shaped by the same community token.

[8] https://outlierventures.io/research/understanding-social-tokens/

[9] It is a long-time discussion in Indonesia to do so: https://www.reuters.com/article/indonesia-rupiah-idUKL4N1EE2UN

[10] Still an ongoing debate: https://voi.id/en/economy/204176

Token economics and distribution

This is a sensitive subject to put down on paper at this stage. We, therefore, request that you do not take this subject as a dictate; it will remain a discussion until we program the tokens in a smart contract and register them on the blockchain or sub-net, and they become usable by anyone. However, we have to start somewhere, and after many calculations, we have arrived at the following figures that we can work with.

Details on Utility Tokenomics

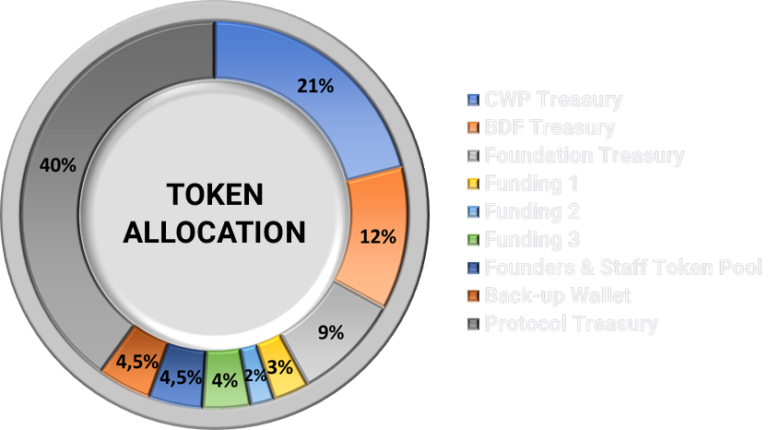

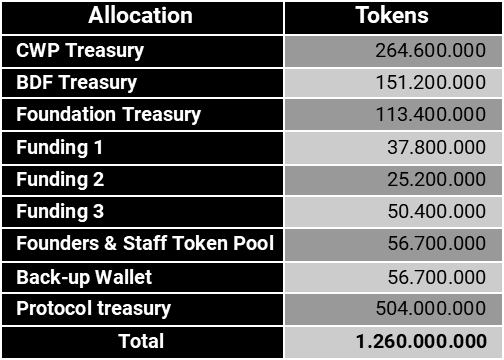

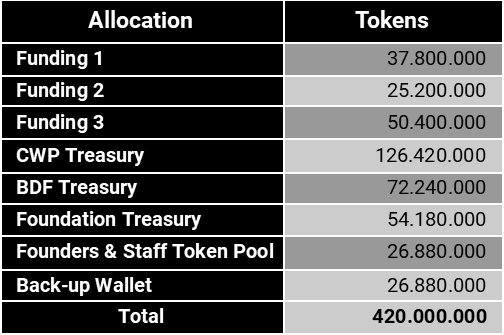

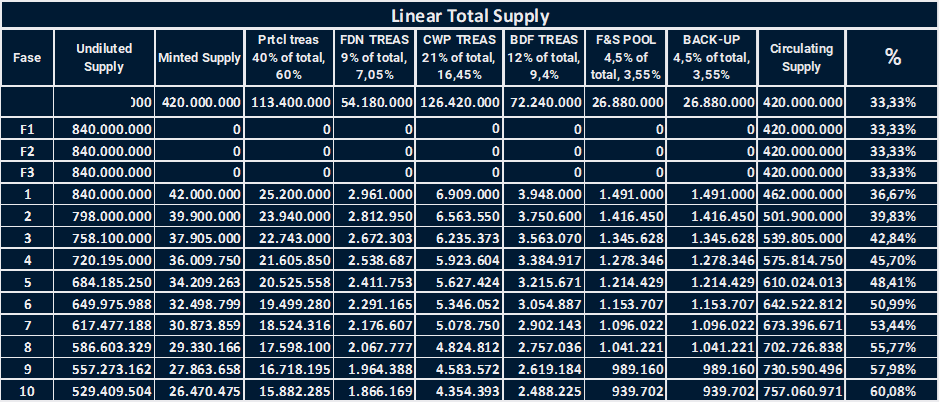

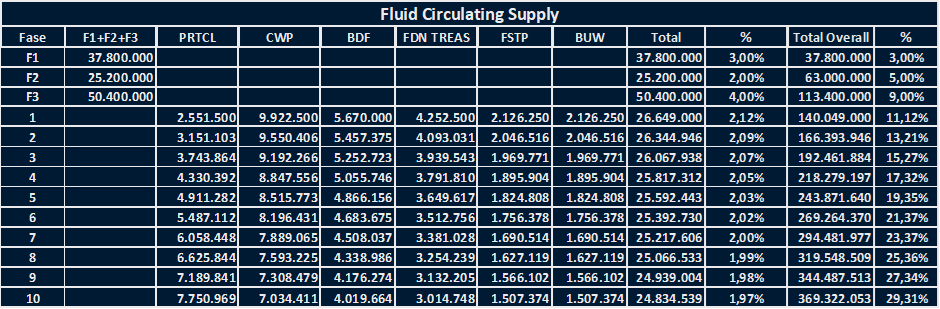

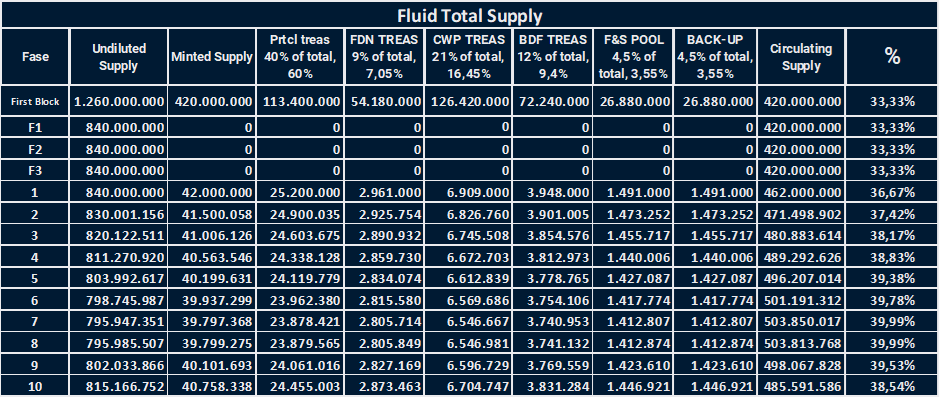

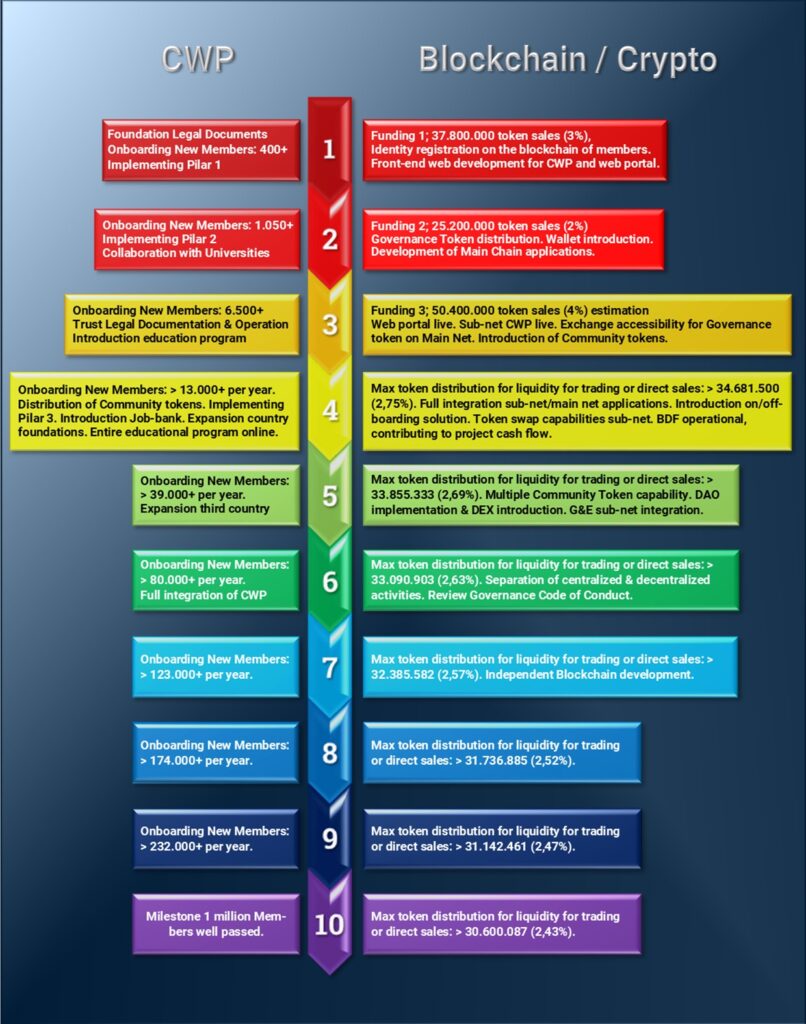

The Utility token has a maximum supply of 1,260,000,000 (one billion two hundred and sixty million) tokens. The first block will contain 420,000,000 (four hundred and twenty million). These tokens have a destination; only some of the range will be intended for the general public. This project differs from many other blockchain projects in that it will have an existing user base from the beginning of the project. A significant part of the tokens will be used for this purpose.

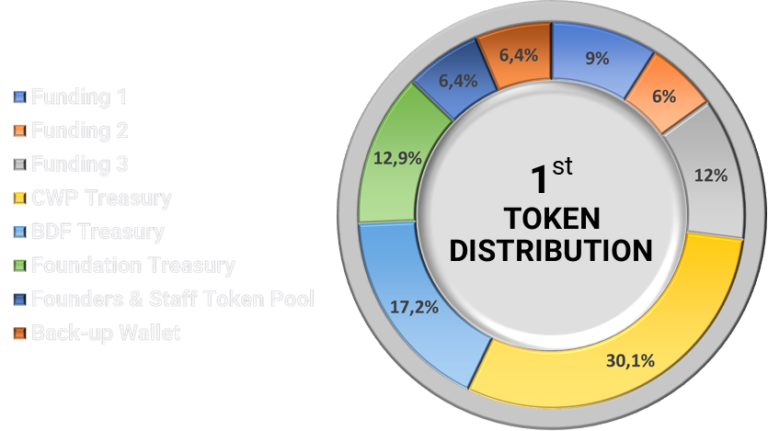

Looking at the maximum supply, the Utility-tokens will be awarded as follows:

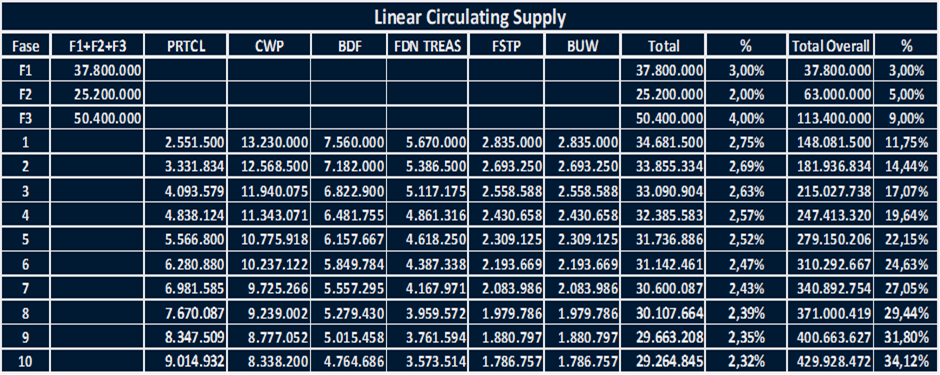

However, this amount of tokens is not allocated directly. One-third of all tokens are released from the start of the blockchain project. But ultimately, this will be the allocation and distribution of the tokens. Each component also has a different purpose for using the tokens. As the name suggests, the tokens in Funding 1 to 3 are sold directly to the public in three rounds. The first round is also referred to as a pre-financing or seed round. Fifty percent of the proceeds from each round go directly to the CWP to onboard members. Therefore, these resources intended for the CWP may not be spent on operational costs. The other half of the available resources will be used for further project development.

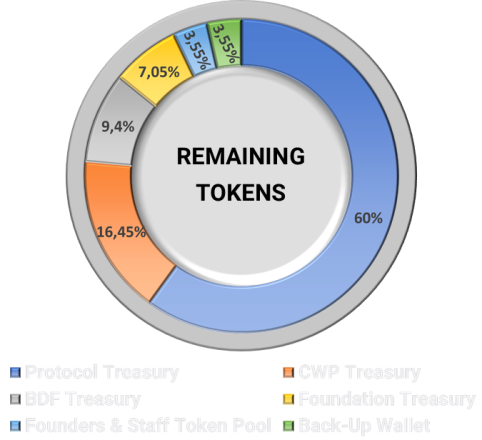

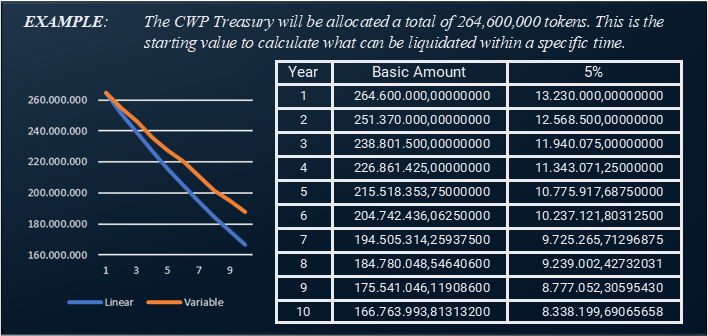

Then a significant part of the tokens will remain available in a reserve pool, which will not be allocated in one transaction. Five percent of the total will become available from the reserve pool every 365 days. This is, therefore, not 20 transactions over 20 years, but every year the reserve has a new total, and 5% of this total will be newly released. Of this, a majority (60%) of the tokens are intended for the protocol treasury, from which validators and delegators are reimbursed for the services they provide.

The distribution of the tokens of the annual mint block will be as follows:

Before continuing to explain the allocation and distribution of tokens, we need to clarify a few supply terminology:

Max Supply

The best approximation of the maximum amount of coins that will ever exist in the cryptocurrency’s lifetime. [11]

What Is Max Supply?

Max supply is the best approximation of the maximum amount of coins that will ever exist in the cryptocurrency’s lifetime. Once the maximum supply is exhausted, no new coins or tokens will be produced or mined.